When we think about Social Security, we often associate it with those who need financial help in retirement. But what if you’re financially independent? What if you’ve done everything right, built significant wealth, and no longer rely on a paycheck? Should Social Security still be part of your retirement plan?

The short answer: yes.

Even if you’re wealthy, Social Security benefits still matter, and today we’ll explore why you shouldn’t overlook them, how to think about them strategically, and most importantly, how to maximize your Social Security benefits to fit into your broader financial picture.

Listen Now: iTunes | Spotify | iHeartRadio | Amazon Music

The Common Misconception: “It Doesn’t Matter”

Every so often, I speak with individuals who’ve done exceptionally well for themselves. They’re financially independent, own multiple assets, and feel like they’ve already “won the game” when it comes to money. Naturally, they assume Social Security is irrelevant to their situation.

Their mindset tends to be:

“Why should I care? I don’t need it.”

And honestly, I get it. If you’ve saved well, built a solid investment portfolio, and have multiple income streams, Social Security may seem like small potatoes. But there are several reasons this thinking may be short-sighted.

Reason #1: You Paid Into It, It’s Your Money

One of the most important things to remember is this: Social Security isn’t a handout.

You paid into the system for decades. Every paycheck you earned, every tax year you contributed, those funds weren’t just donations. You earned credits (40 of them, to be exact) that now qualify you for a benefit. Claiming Social Security is not about need, it’s about reclaiming what’s yours.

Even if the monthly check doesn’t make a big impact on your budget, ignoring your benefit is like leaving money on the table. Think about it: would you willingly skip collecting on a pension or a rental check just because your portfolio is doing well?

Reason #2: It Can Be Strategically Used (Or Reallocated)

Another common argument is: “Even if I take it, I don’t need the income.”

But that’s where a mindset shift is helpful. You don’t have to use the benefit to fund your lifestyle. You can redirect it toward:

-

Charitable giving

-

Helping your children or grandchildren

-

Funding a donor-advised fund

-

Investing in a cause or startup you believe in

-

Offsetting health care costs

-

Replacing portfolio withdrawals in down markets

The point is: just because you don’t need the income doesn’t mean it shouldn’t be put to good use.

Reason #3: It’s One of the Few Sources of Guaranteed Income

In a world of market volatility and rising costs, guaranteed income is incredibly valuable. Social Security is one of the only income streams that’s inflation-adjusted and backed by the U.S. government.

For wealthy retirees, having another layer of stable income allows more flexibility with your investments. Maybe you want to delay tapping into your IRA to let it grow. Maybe you want to cover basic expenses with guaranteed funds and let your risk assets ride. Social Security gives you options, and options are power.

But Isn’t the System Running Out of Money?

This is a concern many people have, and it’s valid to a degree. We’ve all heard the headlines: “Social Security will be insolvent by 2030.” But let’s look at the facts:

-

The trust fund reserves are expected to run low by the early 2030s.

-

This doesn’t mean benefits go away. It means incoming payroll taxes will only cover around 75–80% of scheduled benefits unless action is taken.

-

Congress has a long track record of addressing funding issues when needed. It’s politically unpopular to cut Social Security benefits for current retirees, and it’s unlikely to happen without major pushback.

So while the system may see adjustments, perhaps higher income thresholds, delayed full retirement ages, or increased taxes, it’s not disappearing.

And in the meantime, your benefit is still valid and accessible.

How to Maximize Your Social Security Benefits

Now that we’ve established why Social Security matters, let’s talk about how to maximize your Social Security benefits. There are a few key levers you can pull:

1. Delay Claiming (If Possible)

Your benefit increases the longer you wait to claim it. Here’s the breakdown:

-

Full Retirement Age (FRA): For most people, this is between 66 and 67.

-

Claiming Early (age 62): Results in a permanent reduction of up to 30%.

-

Delaying Until 70: Increases your benefit by roughly 8% per year past FRA.

If you’re in good health and don’t need the income, delaying until age 70 can provide the largest monthly benefit, up to 76% more than claiming at age 62.

For someone with wealth and longevity, this can be a smart play.

2. Coordinate Spousal Benefits

If you’re married, you may be eligible for spousal or survivor benefits, which can be up to 50% of your spouse’s benefit (or even 100% if they pass away).

This can be especially valuable if one spouse didn’t earn as much or took time out of the workforce. Strategizing when each spouse claims can help you maximize the total household payout over your lifetime.

3. Watch Your Taxes

Social Security benefits can be taxed, especially if you have other sources of income like pensions, dividends, or required minimum distributions (RMDs). Wealthy retirees should work with a Certified Financial Planner to structure withdrawals in a tax-efficient way. With smart planning, you can minimize how much of your Social Security gets taxed and keep more of your benefits.

4. Use Social Security as a Safety Net

Some people worry about the “what-ifs” in retirement. Market crashes. Health issues. Family emergencies.

Even if you’re wealthy now, having Social Security as a consistent income stream adds stability. You may not use it for years, but if something changes—your expenses increase, your portfolio dips, your family situation shifts, you’ll be glad to have it.

Think of it as a built-in buffer in your financial life.

5. Incorporate It Into Your Philanthropy or Legacy Plan

If you don’t need the money and don’t want to keep it, that’s fine. But take it anyway—and repurpose it.

Ideas include:

-

Direct donations to charity

-

Annual gifts to heirs

-

Contributions to 529 plans

-

Support for causes or communities you care about

The bottom line: you still control how it’s used.

What About the Ethics of Taking It If You Don’t Need It?

Some people hesitate to claim Social Security out of principle. They feel it should “go to someone who needs it more.”

That’s admirable, but not how the system works.

Social Security is not a needs-based program. It’s an earned benefit. If you’re eligible, you have every right to claim it.

If you want to use it for good, do that, but don’t decline it outright. Claim it, then donate it. Help your family. Fund change in the world. It’s still your money.

Final Thoughts: Don’t Leave Money on the Table

Social Security may not be flashy. It may not feel urgent when your net worth is high. But that doesn’t make it irrelevant.

In fact, maximizing your Social Security benefits is a smart move for anyone, regardless of wealth. Whether you reinvest it, give it away, or use it to supplement your lifestyle, it’s a piece of your financial puzzle that shouldn’t be ignored.

You’ve earned it. Don’t leave it behind.

Next Steps

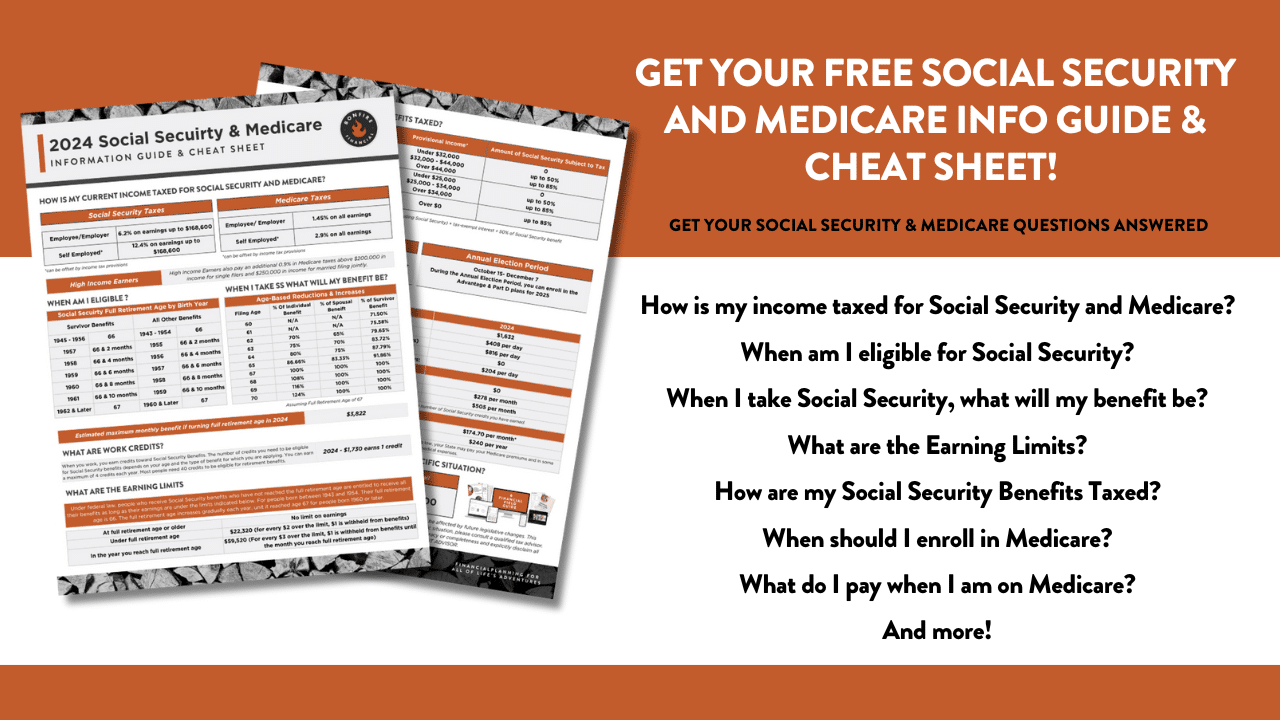

At Bonfire Financial, we help clients of all income levels make informed, strategic decisions about when and how to claim Social Security. We also offer a FREE Social Security and Medicare Guide & Cheat Sheet that’s updated annually to help you assess your options.

Client Login

Client Login