Is it time for an Insurance Review?

Most people wouldn’t dream of ignoring their investment portfolio for decades. Yet that’s exactly what many do with their insurance policies.

You might glance at your 401k quarterly. You probably know how the S&P 500 is doing right now. But when’s the last time you did an insurance review or even pulled out your life insurance paperwork?

If it’s been a while, or if you don’t even remember where it is, you’re not alone.

Listen Now: iTunes | Spotify | iHeartRadio | Amazon Music

The Case for an Insurance Review

An insurance review is the financial equivalent of a health checkup. It doesn’t mean anything is necessarily wrong, but it ensures that what you put in place years ago still works for your life today.

Life changes. So do your financial goals. The insurance industry itself has evolved in ways that might give you better options, more flexibility, and even save you money.

Take, for example, a recent client of ours who had been paying premiums on a whole life policy for decades. As he approached retirement, that premium became a growing concern for his monthly cash flow. After an insurance review, we were able to convert it into a paid-up plan with a higher death benefit and added long-term care coverage, without any new out-of-pocket costs.

It was a win on every front.

Insurance Isn’t an Investment, But It Protects One

Let’s clear something up: insurance is not an investment. When you buy a stock, you’re hoping it goes up in value. You expect returns.

Insurance, on the other hand, is a tool to protect your investments. It’s a hedge against life’s unpredictable events, death, disability, and disasters that could otherwise dismantle your financial plan.

Think of it this way:

-

Your home may appreciate in value, but you buy homeowner’s insurance to protect it from fire, theft, or natural disasters.

-

Your car may be paid off, but you still insure it because accidents happen.

-

Your life is your most valuable asset. Life insurance isn’t a be, it’s a safety net.

An insurance review ensures that safety net is strong, relevant, and still serves your current needs.

When Life Changes, So Should Your Coverage

Most people buy life insurance at major life milestones: starting a family, buying a house, or getting married. But they rarely revisit those policies when things shift again.

What happens when:

-

The mortgage is paid off?

-

The kids graduate and move out?

-

You’re preparing to retire?

These are key moments when your financial priorities change. That old policy might no longer be the best solution—or it might be missing new features that would better support your current goals.

A review can help answer questions like:

-

Do I still need this much coverage?

-

Am I paying more than I need to?

-

Can I add long-term care or other benefits?

-

Would a different structure serve me better in retirement?

The Hidden Costs of “Set It and Forget It”

Insurance is often on autopilot. Policies are drafted, premiums are set on auto-pay, and years go by with no changes. But while you’ve changed, your policy hasn’t.

This can lead to:

-

Overpaying for coverage you no longer need

-

Missing out on newer products with better terms

-

Gaps in protection due to outdated coverage

-

Lack of clarity around cash value, death benefits, or premium structure

A proper insurance review isn’t about selling you something new, it’s about aligning your current coverage with your current life.

Common Review Triggers

Here are a few specific times when it makes sense to schedule a policy review:

1. Approaching Retirement

As income changes and fixed budgets become more important, reviewing insurance premiums and benefits is essential. You may discover ways to free up cash flow or convert policies into paid-up plans with no more premium obligations.

2. Family Milestones

Getting married, having children, or becoming empty nesters are all good times to reassess. Do you have enough coverage to support your dependents? Is your spouse adequately protected?

3. New Property or Debt

A new home or loan may require adjustments in your umbrella or life insurance coverage. Don’t let your protection lag behind your liabilities.

4. Business Changes

Whether starting, selling, or inheriting a business, your risk exposure and protection needs change. Business succession plans, key-person insurance, and buy-sell agreements may need review.

5. Health Events

If you or your spouse experience a major health change, reviewing your insurance ensures your plan is still feasible—and if applicable, prepares for long-term care needs.

6. Policy Age

If your policy is over 10 years old, it’s worth looking into. Even if your situation hasn’t changed much, the insurance industry has. New riders, features, and products may offer better options today.

What to Expect in an Insurance Review

A thorough insurance review should include:

-

Review of Existing Policies: We look at what you have—term, whole life, universal, etc.—and how they’re structured.

-

Needs Analysis: We assess your current stage of life, goals, cash flow, liabilities, and protection gaps.

-

Product Comparison: If applicable, we compare alternatives, including newer products that may have better features or cost structures.

-

Tax Considerations: Some policies accumulate cash value and may offer tax-advantaged features that should be weighed carefully.

-

Estate Planning Fit: For high-net-worth individuals, life insurance often plays a role in estate planning and wealth transfer. A review ensures your policy still fits within your long-term strategy.

Real Talk: Commission vs. Fiduciary

It’s important to understand that insurance products can carry commissions. This doesn’t mean they’re bad, but it does mean you should be cautious of who’s giving you advice.

Whenever possible, seek out a fiduciary advisor, someone legally required to put your interests ahead of their own. This ensures that the advice you receive is based on your needs, not the advisor’s commission.

At Bonfire Financial, for example, we’re fiduciaries. We disclose any potential conflicts of interest, and we’re focused on long-term relationships, not one-time sales.

The Retirement Angle: A Missed Opportunity?

Many retirees continue paying life insurance premiums because that’s what they’ve always done. But at this stage, their needs have shifted from income replacement to legacy planning, long-term care, or cash flow optimization.

Sometimes, a review reveals an opportunity to:

-

Convert to a paid-up plan and stop future premiums

-

Tap into existing cash value

-

Exchange an older policy for a new one with long-term care features

-

Reduce the death benefit in favor of lower costs or supplemental retirement income

Every situation is different, but what’s common is this: without an insurance review, these options remain invisible.

Other Policies That Deserve a Look

It’s not just life insurance that should be reviewed. You should also periodically review:

1. Homeowner’s Insurance

If your property value has changed or you’ve made renovations, your policy may be out of date. Rising construction costs and natural disasters can also impact premiums and deductibles. Take the time to review your homeowner’s coverage.

2. Auto Insurance

If you’re driving less, bundling with home insurance, or have a teen driver now on the road, your policy should reflect these changes.

3. Umbrella Policies

These policies offer extended liability protection. As your net worth grows, your coverage should grow too. Many people outgrow their umbrella coverage and don’t realize it.

4. Disability Insurance

Often overlooked, disability coverage is a key protection during working years. If your income has changed or you’ve started a business, your existing policy might not provide enough replacement.

A 1% Change Can Yield Big Results

You don’t need to overhaul everything. Sometimes, small changes during a review, like adjusting a deductible or adding a ride, can lead to better protection and long-term savings.

Think of it as optimization. Even a 1% improvement compounded over time can add up to thousands in savings or value gained.

And sometimes, the biggest win isn’t financial, it’s peace of mind.

How Often Should You Review?

At a minimum, conduct a full insurance review every two years. But if you’ve had any major life events, or your policy is more than a decade old, don’t wait.

If you’re unsure where to start, work with a qualified advisor who can walk you through the review process, explain your options in plain language, and help you make confident, informed decisions.

Final Thoughts: Protect What Matters

Your investments, your family, your home, your health, these are the things that matter most. Insurance doesn’t grow your wealth, but it shields it.

Make sure that shield is still strong.

If you haven’t reviewed your insurance in years (or ever), now is the time. Don’t let an old policy create new problems.

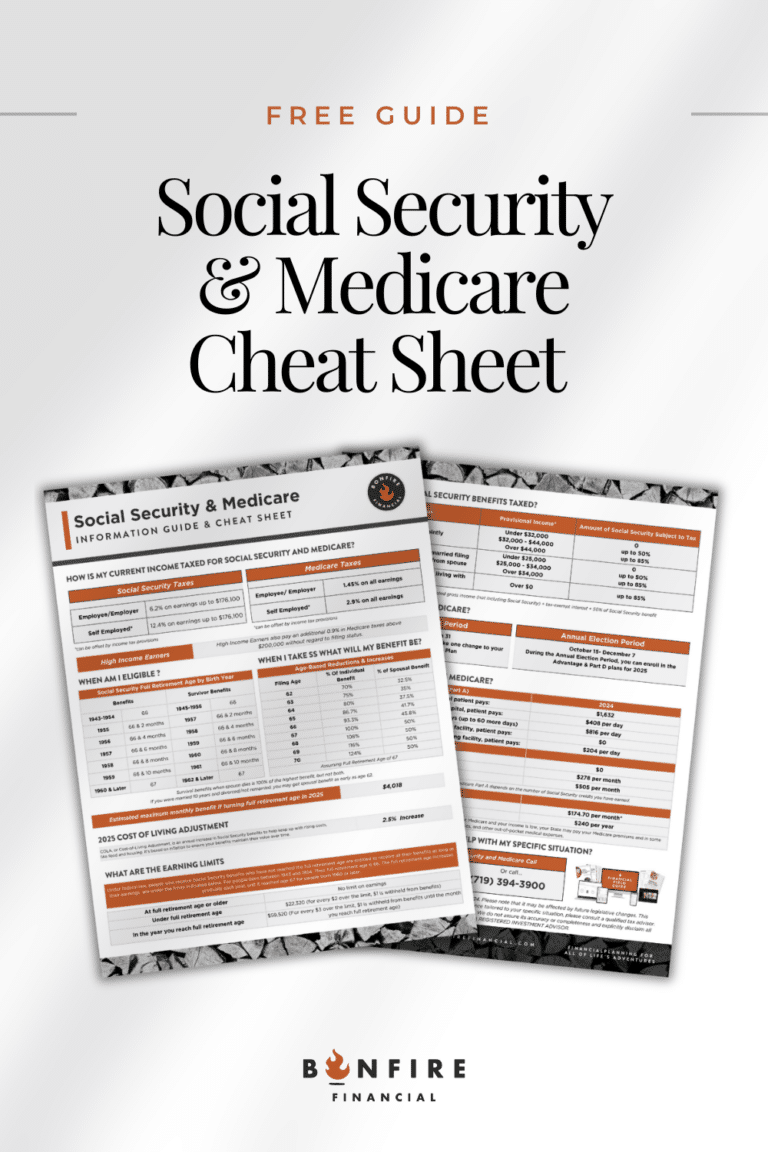

Need a second opinion on your coverage?

We offer comprehensive insurance reviews with no obligation. We’ll help you understand what you have, what you might need, and whether there are smarter ways to protect your financial future.

Let’s talk… schedule your call now, because when life changes, your insurance should too.

Client Login

Client Login