One of the most disruptive elements to any well-crafted financial plan is the unpredictable nature of medical expenses. Enter the Health Savings Account (HSA), a powerful tool that can change how you manage and mitigate healthcare costs both now and in retirement. Tune in to the most recent episode of The Field Guide Podcast, with Brian Colvert, CFP® to learn about its unique benefits and how you can navigate the ever-changing terrain of healthcare costs with confidence.

Listen Now:

iTunes | Spotify | iHeartRadio | Amazon Music

A Health Savings Account is like a supercharged savings account specifically designed for qualified medical expenses. They offer a powerful triple tax advantage, allowing you to save money on healthcare while maximizing your tax benefits.

Today we will dive into Health Savings Accounts, exploring their advantages, eligibility requirements, and how to determine if it is the right fit for you.

The Rising Tide of Healthcare Costs: Why Health Savings Accounts Matter

A crucial factor to consider when it comes to healthcare savings is the cost of inflation. Medical expenses have historically inflated at a rate significantly higher than general inflation. This means the cost of staying healthy is likely to increase substantially over time. Whether it is prescriptions, medical insurance insurance, surgeries, or whatever else might come along, the cost of medical care is going to cost more in the future. A Health Savings Account quite possibly is the best tool out there to help you cover these costs.

Unveiling the Power of HSAs: Triple Tax Benefits

HSAs stand out for their unique ability to offer a triple tax advantage. This means you get tax breaks at three crucial stages:

- Contributions: When you contribute money to your HSA, it’s deducted from your taxable income. This can significantly reduce your tax burden in the year you contribute.

- Growth: The money in your HSA has the potential to grow tax-free through interest or investments offered by some HSA providers.

- Withdrawals: The best part? When you use your HSA funds to pay for qualified medical expenses, those withdrawals are completely tax-free.

Let’s break down an example to illustrate the power of this triple tax benefit. Imagine you earn $200,000 annually and contribute the maximum HSA contribution of $4,150 (Limit as of 2024- Click here to get the most current limits) in pre-tax dollars. Assuming a 25% tax bracket, you’d effectively save $1,037.5 on taxes right off the bat.

Now, let’s say your HSA earns a 2% annual interest rate. Over ten years, your pre-tax contributions and interest earned would grow tax-free. Finally, when you withdraw those funds to pay for qualified medical expenses, you won’t owe any taxes on the withdrawal.

This triple tax advantage makes HSAs a highly attractive option for individuals aiming to save for current and future healthcare needs while minimizing their tax burden.

Making Your HSA Work for You: A Long-Term Strategy

Let’s talk about how to maximize the benefits of your HSA. Here’s a strategy we recommend: think of your HSA as a health savings bank.

As of 2024, the annual contribution limit for HSAs is $4,150 for individuals and $8,300 for families (with an additional $1,000 catch-up contribution allowed for individuals over 55). Click here to get the most current limits That’s a significant amount you can save each year towards future healthcare needs.

Here’s the key: during your working years, while you likely have a steady income, aim to cover your current medical expenses directly. This includes premiums, doctor visits, prescriptions, and anything else that comes up.

The real power of HSAs lies in their long-term potential. Instead of spending your HSA contributions right away, contribute the maximum allowed and invest those funds within your HSA. This allows your money to grow tax-free over time.

Imagine consistently contributing close to the maximum HSA limit (around $8,300 with catch-up contributions) and achieving a reasonable growth rate over a decade. You could potentially accumulate over $100,000!

This creates a significant tax-advantaged pool of funds you can tap into during retirement. You can use these funds tax-free to cover various healthcare expenses, such as Medicare premiums, surgeries, prescriptions, dental care, or vision needs.

Think of it as a tax-free safety net for your healthcare needs in retirement. By letting your HSA contributions grow over time, you reduce your reliance on withdrawing funds from taxable retirement accounts like 401(k)s or IRAs. This can help minimize your overall tax burden in retirement.

Beyond Savings: The Flexibility of HSAs

HSAs offer more than just tax-advantaged savings. They provide flexibility in managing your healthcare finances:

- Wide Variety of Uses: HSAs can be used to cover a wide range of qualified medical expenses, including deductibles, co-pays, coinsurance, prescriptions, contact lenses, dental care, acupuncture, weight loss programs, and even some over-the-counter medications. Remember: It’s always best to check with your HSA provider to confirm coverage for specific expenses.

- Save for Future Needs: HSAs aren’t limited to immediate medical bills. You can use them to accumulate funds for anticipated future healthcare needs, such as major dental work, vision care, or elective procedures. This allows for proactive financial planning for your health.

- Portability: HSAs are portable, meaning they remain yours even if you change jobs or insurance providers (as long as the new plan is HSA-compatible). This ensures continuity and control over your healthcare savings.

Who Qualifies for a Health Savings Account?

To be eligible for an HSA, you must meet two key requirements:

- High-Deductible Health Plan (HDHP): You must be enrolled in an HSA-qualified High-Deductible Health Plan (HDHP). HDHPs typically have lower monthly premiums but come with higher deductibles – the amount you’re responsible for paying before your insurance kicks in. The IRS sets annual minimum deductible amounts for HDHPs to qualify for HSA contributions. For individuals in 2024, the minimum deductible is $1,400, and for families, it’s $2,800.

- Minimum Health Coverage: You cannot have any other health insurance plan that provides coverage beyond preventive care services while you’re contributing to an HSA.

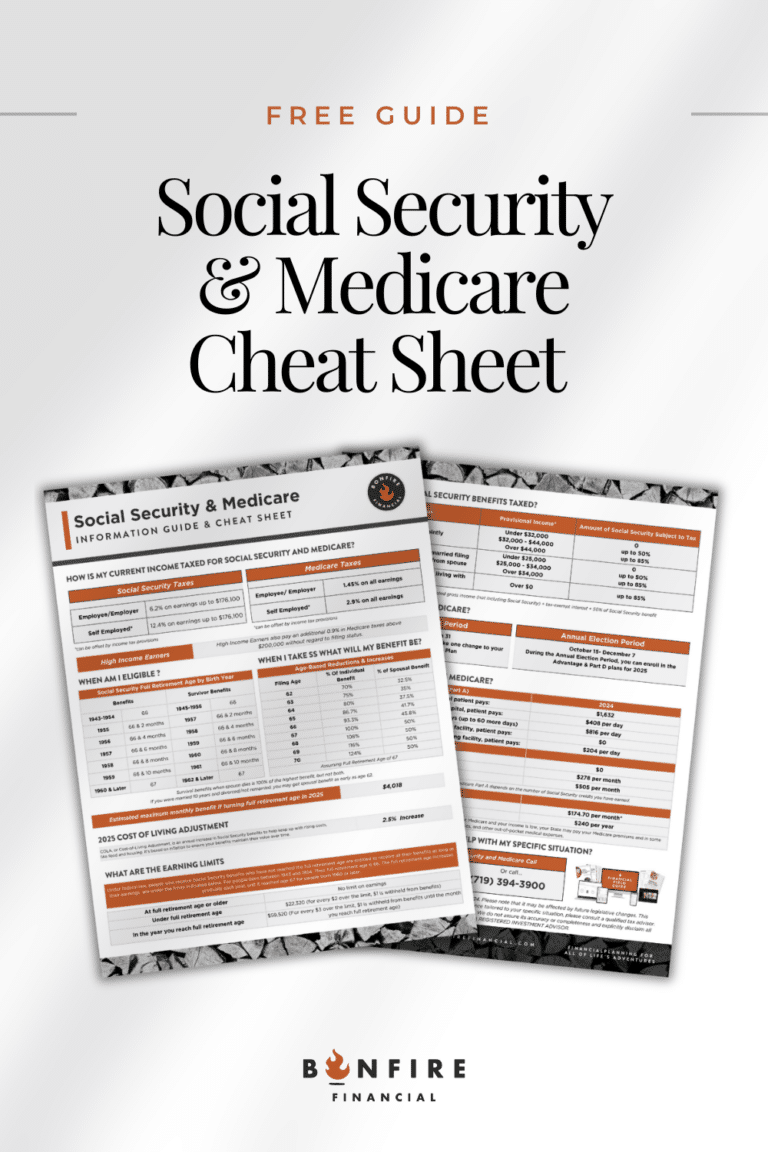

HSA and Medicare

Understanding how Medicare interacts with your Health Savings Account (HSA) is crucial for managing your healthcare expenses effectively. Here’s what you should know:

- Eligibility: You can’t contribute to an HSA once you’re enrolled in Medicare. This means if you’re planning to enroll in Medicare, it might be wise to maximize your contributions to your HSA before you become eligible.

- Contribution Limits: If you have both Medicare and an HSA, your contribution limit to the HSA changes. You’re only allowed to contribute on a prorated basis for the months you were not enrolled in Medicare.

- Qualified Medical Expenses: You can still use the funds in your HSA to pay for qualified medical expenses, even after you’re enrolled in Medicare. However, you can’t use HSA funds to pay for premiums for Medicare supplemental policies (Medigap) or Medicare Advantage plans.

- Tax Implications: Withdrawals from your HSA for qualified medical expenses remain tax-free, even if you’re on Medicare. However, if you withdraw funds for non-medical expenses, you’ll incur a 20% penalty on the amount withdrawn, plus income tax (for those under 65). After age 65, you can withdraw for non-medical expenses penalty-free, but income tax is still applicable.

- Medicare Premiums: You cannot use HSA funds to pay for Medicare premiums (except for certain specific circumstances, such as premiums for qualified long-term care insurance, or premiums for Medicare Part B, Part D, or Medicare Advantage, if you’re over 65).

- Medicare and HSA coordination: When you enroll in Medicare, you should stop making contributions to your HSA. However, you can still use the funds in your existing HSA to pay for qualified medical expenses. Additionally, you may choose to withdraw funds from your HSA to cover Medicare premiums and out-of-pocket medical expenses.

- Healthcare Costs in Retirement: While Medicare provides coverage for many healthcare expenses, it doesn’t cover everything. Having an HSA can be a valuable tool for covering co-pays, deductibles, and other out-of-pocket expenses in retirement.

Need more information on Medicare- Grab out FREE Medicare Cheat Sheet!

Is an HSA Right for You? Making an Informed Decision

While HSAs offer significant advantages, they might not be the perfect fit for everyone. Here are some key factors to consider:

- Health Status: If you anticipate needing frequent medical care, the higher out-of-pocket costs associated with HDHPs might outweigh the tax benefits of an HSA.

- Financial Stability: Ensure you have a financial safety net to cover your deductible in case of unexpected medical bills.

- Future Healthcare Needs: If you foresee significant healthcare expenses in the future, an HSA can be a valuable tool to accumulate funds and prepare for those costs.

Maximizing Your HSA Advantage: Getting Started

If you’ve decided an HSA aligns with your financial goals, here’s how to get started and make the most of it:

- Open an HSA: Many employers offer HSAs through payroll deductions. You can also open an HSA directly with wth us. Get started by booking an appointment.

- Contribute Strategically: The IRS sets annual contribution limits for HSAs. Contribute as much as your budget allows to maximize your tax savings and long-term healthcare savings.

- Plan for Deductible Expenses: Set aside funds in a separate savings account or budget to cover your deductible in case of unexpected medical bills. This will prevent dipping into your HSA funds prematurely and ensure you have access to tax-advantaged dollars for future needs.

- Track and Manage Expenses: Maintain clear records of your HSA contributions, qualified medical expenses, and withdrawals. Many HSA providers offer online tools and mobile apps to simplify expense tracking and ensure you stay compliant with IRS regulations.

Leveraging HSAs for Long-Term Healthcare Savings

HSAs are powerful tools for long-term healthcare savings. Here are some strategies to get the most out of them for the future:

- Invest Your HSA Funds: Some HSA providers offer investment options. Consider investing a portion of your HSA funds for long-term growth. Potentially outpacing inflation and accumulating a larger nest egg for future healthcare needs. Not sure where to start, book a free consultation call with us.

- Pay Yourself Back: If you pay for qualified medical expenses out of pocket, you can reimburse yourself from your HSA funds later, even years down the line. Keep receipts for qualified expenses to ensure proper documentation.

Conclusion: Your Empowered Path to Healthcare Savings

Health Savings Accounts offer a unique opportunity to take control of your healthcare finances. By understanding the tax advantages, eligibility requirements, and strategic use of HSAs, you can significantly reduce your healthcare costs and build a secure financial future for your health.

Ready to explore a Health Savings Account further?

We are here to help answer any questions you may have about HSAs. Book a call with us today!

Client Login

Client Login