Roth 401k or Traditional 401k?

The 401k plan is the cornerstone of retirement. Gone are the days of big company and school district annual pensions and generous social security benefits. It’s now up to you to plan and save for retirement. In addition to all the expenses that go with it. Luckily, a Roth 401k or Traditional 401k is a fantastic tool. One of the best that you can use to save for your retirement and goals. However, there is a lot to understand about how they work and how to use the 401k for your best outcome.

A little background

The purpose of the 401k plan is to save for retirement. An employee can contribute $23,500 of their own money to their account and an additional $7,500 if they are over 50 years old per year as of 2025. Please always check here for the current year’s limits. Some plans also allow you to contribute to a Roth 401k. Many people wonder if this may be a better option for them. We’ll explore the key differences between a Roth 401k or a Traditional 401k so you can make a confident decision.

The Roth 401k

The Roth 401k is a relatively new concept. It was introduced in 2001 for the purpose of allowing employees to take taxes now and forever shield the gains from tax. Many people see the benefits of contributing to the Roth 401k. However, some are hesitant as to whether the traditional tax-deferred 401k will still be better for them because of its favorable tax deferral.

The money you add to the Roth is still considered income. You will be taxed on that amount. Once your savings in the account have been taxed at your regular income level, it will grow tax-free. Then, when you take money out of it, that will also be tax-free.

This is a great option if you do not want to pay extra tax in your retirement. Also, good if you are in a lower tax bracket than you expect to be in the future.

Example

As an example, if you contribute $25,000 to your Roth 401k at the 22% tax bracket, you will still pay $5,500 as a part of your tax bill. Let’s say if you contribute $25,000 annually for 10 years at a rate of 8%, you would be the owner of an account that has $362,164 completely tax-free! The benefit of having a Roth is that you will never pay taxes on the gains that you make in the account. If your account is still around for your heirs, they will not have to pay any tax either!

Having this option will allow you to grow your money. Additionally, you will not have to worry about paying extra taxes. It is important to note that your employer does NOT match your contribution on a Roth basis if you do. They will continue to match your contribution, but it will only be in traditional tax-deferred dollars.

Let’s say your company matches you 3% of your salary. If you are in the plan and make $100,000, you will be contributing $3,000 each year into your Roth 401k. Plus, your company will contribute $3,000 to the traditional 401k. They will be in the same account but will be accounted for separately by the administrator of the company 401k plan. When you are deciding, if you can afford to do the Roth 401k, you absolutely should.

The Traditional 401k

The traditional 401k allows an employee to defer their income of what they contribute. That means if you made $100,000 and decided to contribute $25,000 to your 401k, you will only have to report $75,000 to the IRS. This is because you “deferred” your income into the account. Once you retire and withdraw that money, you will have to pay the income that you “realized” at the tax rate you are at when you withdraw.

The advantage of the traditional 401k is that you get to defer your income and save it while it grows in your account. When you retire, you may move your traditional 401k to an IRA. As an example, you made $170,000 as a married couple. At $170,000, you are pushed into the 24% tax bracket (over $168,450 Married Filing Jointly). But because you understand the 401k can defer your income, you decide to defer $15,000 into the account, dropping you out of the 24% bracket and into the 22% bracket, which saves you money!

The traditional 401k is best if your cash flow is tight. It is extremely important to save for your retirement. You should always save 10% or more of your salary as a rule of thumb. When you save on taxes, you will be saving yourself money.

Example

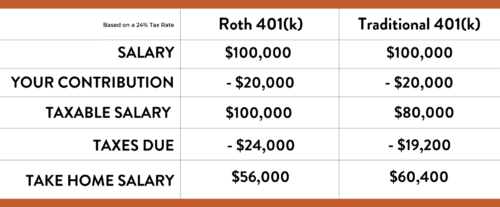

Here is an example that will illustrate how your contributions of $20,000 affect your cash flow.

Here we can see with a salary of $100,000 we cannot defer any money from taxes if we contribute $20,000 into the Roth 401k. Our total taxes at 24% will be $24,000 for the year. If we contribute $20,000 to the traditional 401k, we will defer that money from taxes, so only $80,000 will be taxed at 24%. At the end of the year, using the traditional will save us $4,400, which is $367 per month. If that money is needed for your cash flow, do the traditional. If you can take the hit now on taxes, you should do the Roth 401k.

Which one is best for me?

You are weighing now versus later. If you are just starting out in your career and are in the lower tax brackets you should contribute to the Roth 401k. At the end of the year, you will have a bigger tax bill from Uncle Sam because you recognized all of your Roth contributions. Have no fear! Your Roth retirement account will grow tax-free all the way up until you retire. Plus, all the gains that you have made throughout those years will be tax-free as well!

If you have a good handle on your cash flow, you should contribute to the Roth 401k. If cash flow is an issue you can use the traditional 401k to lower your tax bill. You get to defer that income and save it in a tax-deferred account that will grow. Once you take money out of the account, you will have to pay income tax on it. This can be quite advantageous if you are at the top of your career and at the higher tax brackets. If you believe that you will be in a lower bracket when you retire, the traditional is your best bet.

The Backdoor Roth IRA

People want to enjoy deferring their income to save on taxes but also want the ability to have a Roth account that they can draw from tax-free in retirement. Many people close to retirement are looking at all the taxes they have saved in their accounts and now see a huge dollar sign going to the government every time they take money out for their retirement expenses.

The Backdoor Roth IRA allows a person to continue to defer their income through their 401k, but also contribute $6,000 (plus $1,000 if over 50) per spouse into a Roth IRA. A married couple can contribute up to $14,000 each year to Roth IRAs. If this planning technique is done for 5 – 10 years before retiring, this would give a retiring couple a substantial tax-free account.

Example

As an example, if a married couple were to contribute the max amount of $14,000 for 10 years. Assuming a yearly return of 8%, they would have $202,811.87 of assets that would never be taxed again! The benefit of a Roth is also that there are no Required Minimum Distributions as there are with a traditional account. If a married couple paired the backdoor Roth IRA with the 401k plan, they would have an effective diversification of their tax accounts, which would be very helpful in retirement.

This is a complex planning strategy. It is important to work with a financial advisor who understands your objectives and will help you leverage your current situation to help you meet your expectations.

The Bottom Line

If you can stomach the tighter cash flow and you suspect that you may be in a higher tax bracket, the 401k Roth is best for you. If you are tight on cash flow and could use the extra money while also saving for your retirement, the traditional 401k is for you. Also, if you suspect to be in a lower tax bracket in the future when you take out money, the traditional 401k is what you should choose.

The Backdoor Roth IRA is great for people who wish to save in a traditional 401k to take advantage of the tax deduction, but also want to grow a Roth IRA that will never be taxed. Using this mechanism, a single person could add $62,000 into a traditional 401k and $7,000 into a Roth IRA.

What’s next?

Interested in learning about the differences between an IRA and a 401k? Read up on that here. Still have questions? Please feel free to contact us! 719-394-3900- We offer a free 30-minute strategy call that can help answer many of your questions.

Client Login

Client Login