Roth IRA Mistakes

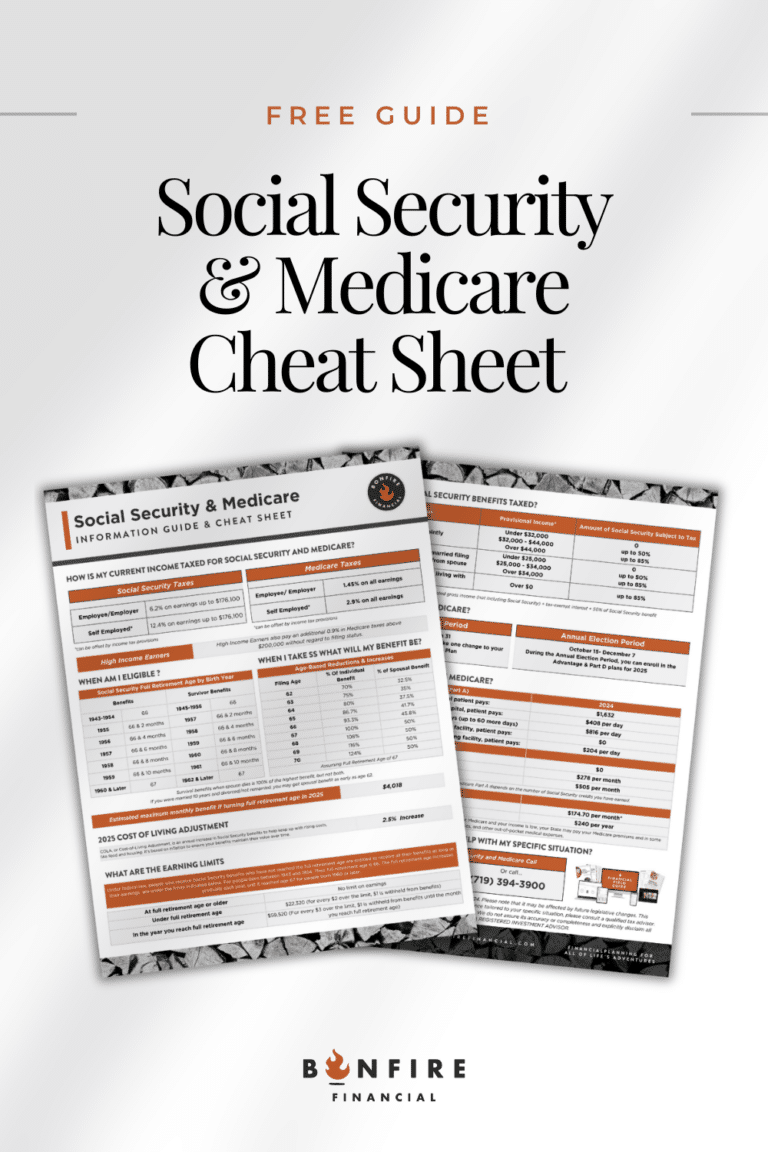

An individual retirement account (IRA), specifically a Roth IRA, is a great option to save for retirement. One of the significant advantages of a Roth IRA is that, while contributions are not tax-deductible at the time you make them, the distributions can grow tax-free. This differs from a traditional IRA, where contributions may be tax-deductible, but withdrawals are taxed at your income tax rate.

A Roth IRA offers a unique opportunity to invest in an account that allows your contributions and earnings to grow without being taxed upon withdrawal. Over time, this can result in substantial tax-free savings. While you may not achieve the same extraordinary results as some high-profile investors, any amount of tax-free growth can make a significant difference in your financial future. The earlier you start, the more time your contributions have to compound, making a Roth IRA a powerful tool for long-term wealth building.

View current contribution numbers limits here.

Many pre-retirees want to find more ways to save for retirement. They also want to make sure they are setting themselves up for a better tax situation when they start taking money out of their accounts.

However, there are several common mistakes we see that cause people major tax issues or nullify their contributions. Below are the most common mistakes we find and how to avoid them

Mistake #1 – Contributing When You Don’t Qualify

The government wants people to save, however, they don’t want them to be able to save too much. As such, you can earn too much to contribute to a Roth IRA. Whether you’re eligible is determined by your modified adjusted gross income. Plus the income limits for Roth IRAs are adjusted periodically by the IRS. As such Roth IRA mistakes can be made.

If you make contributions when you don’t qualify, it’s considered an excess contribution. The IRS will charge a tax penalty on the excess amount for each year it stays in your account.

How to avoid it:

If you’re close to the income limits, one way to avoid the extra tax penalty is to wait until you’re about to file your taxes. Then you can see how much if anything you can contribute. You have until the day your taxes are due to fund a Roth IRA. This way, you avoid making the mistake of contributing more than the allowable maximum. Plus, helps to avoid paying unexpected penalties.

Mistake #2 – Funding more than one Roth IRA

Let’s say you fund a Roth IRA with Bonfire Financial, and also open another Roth IRA at Vanguard, for example, you cannot contribute money to each Roth IRA. If you contribute more than you’re allowed to your Roth IRA, you’ll face the same excise tax penalties on those extra funds.

How to avoid it:

To avoid this problem, be sure to watch and manage the total amount of contributions in all of your Roth IRA accounts. If you do accidentally put in too much, you can make a withdrawal without penalty as long as it is before the tax filing deadline. You also have to withdraw any interest earned.

Mistake #3 – Not Funding your spouse’s Roth IRA

While your contributions to a Roth IRA are limited by the amount of money you’ve earned in a given year, there is an exception. Your spouse! Even if your spouse has no earned income, they can still contribute to their own Roth IRA via the Spousal Roth IRA. You must be legally married and file a joint return to make this work.

How to avoid it:

By using a Spousal IRA, you can double up on your Roth IRA contributions. You can save even more money per year in tax-free dollars if over 50 years old.

Keep in mind that IRAs are individual accounts. As such, a Spousal Roth IRA is not a joint account. Rather, you each have your own IRA—but just one spouse funds them both.

Mistake #4 – Too large of a Roth Conversion

Roth conversions are a good tool to use to make your future earnings tax-free and avoid RMDs in the future. How these conversions work is by moving pre-existing funds in your traditional IRA or traditional 401K into a Roth or Roth 401k. The amount of money that is converted or moved from one account to the other will be taxable at whatever your current income tax bracket is.

One problem that can happen is that if you are close to the next income bracket and you convert funds over to a Roth, some of the conversion could be taxed at a higher rate. It pushes you into the next income bracket. These conversions cannot be reversed. So, if you are not working with an advisor and your tax professional you can inadvertently pay more taxes than you need to.

How to avoid it:

If you have large IRAs or 401k and would like to convert into a Roth, it is best to watch your income brackets and convert an amount of money that would fill your current income tax bracket but not spill over into the next. It is best to use this strategy over multiple years.

Mistake #5 – Not doing a Backdoor Roth

Many of our clients have incomes that are above or well above the Roth IRA income phaseout. Yet they and their spouses are funding their Roth IRA’s fully each year. How?

By using a strategy called the Backdoor Roth Conversion. A Backdoor Roth Conversion is done by funding an empty IRA then immediately converting the IRA dollars into the Roth IRA. In this way, you are funding a traditional IRA and not deducting from your income, also known as a nondeductible IRA contribution, and then converting into the Roth IRA, which is allowed regardless of income. In this strategy, you indirectly fund the Roth IRA and can continue to do this every year going forward.

How to avoid it:

If you make too much money to contribute directly to a Roth IRA, consider doing a Backdoor Roth. There are some drawbacks to converting a traditional IRA to a Roth IRA. Since the money you put into your traditional IRA was pre-tax, you’ll need to pay income tax on it when you do the conversion. It’s possible that this additional income could even bump you up into a higher tax bracket. We highly recommend talking to a CERTIFIED FINANCIAL PLANNER™ about implementing this strategy.

Mistake #6 – Doing a Backdoor Roth with Money in an IRA

One mistake we often see is someone funding a Backdoor Roth IRA while concurrently having pre-tax dollars in other IRA accounts. The reason this is a problem is that the IRS looks at all accounts. And due to the “Pro-rata Rule” treats them as one. You cannot simply just choose to move after-tax dollars into a Roth IRA.

You have to calculate the amount of money that can be moved into a Roth without paying taxes by dividing the amount of after-tax dollars by the total amount of money in all your IRA accounts.

How to avoid it:

A way to avoid this common pitfall is to account for all IRAs. (SEP IRAs, Simple IRAs, and or traditional IRAs)This will help know whether you can contribute without triggering the Pro-rata rule. You could also convert all pre-tax dollars at once. Or, another option would be to roll your IRA money into a 401k so that you no longer have any money in an IRA.

Mistake #7 -Not properly investing the money

One common mistake we see investors make is that they believe the Roth IRA is an investment when it is simply an account. Just because you contribute to a Roth IRA doesn’t mean it is invested automatically.

It is not enough just to open an account. You have to go into the account and select investments and manage them. If you just contribute to a Roth IRA without selecting an investment in the account, it could be just sitting in cash!

How to avoid it:

Invest the money in your Roth IRA. If you are unsure of a good investment strategy, schedule a meeting with one of our CERTIFIED FINANCIAL PLANNER™ professionals. We can help make sure your Roth IRA is invested correctly for you based on your goals, time horizon, and risk tolerance.

Mistake #8 -Not optimizing your Roth Dollars

Oftentimes, we see Roth IRA investors using allocations that are very conservative. Or they match other allocations in their 401(k). This is a massive oversight and not planning for a proper tax allocation strategy. A Roth IRA should be managed more aggressively than your other accounts so that you can take full advantage of the tax-free benefit.

How to avoid it:

Leave the conservative allocation to the after-tax and tax-deferred accounts. A Roth IRA should be as aggressive as you are willing and capable of doing. One advantage of IRAs over 401k plans is that, while most 401k plans have limited investment options, IRAs offer the opportunity to put your money in many types of stocks and other investments.

Mistake #9 – Forgetting to name Beneficiaries

It’s important to name a primary and contingent beneficiary for your IRA accounts. Otherwise, if something happens to you, your estate will have to go through probate. And that can take more time, cost more money, and cause a lot of inconveniences.

How to avoid it:

Name your beneficiaries and be sure to review them periodically and make any changes or updates. This is especially important in the case of divorce. We see a lot of issues arise because a divorce decree won’t prevent a former spouse from getting your assets if he or she is still listed as a beneficiary on those assets.

Mistake #10 -Not having a CFP® Manage your investment and tax strategy

There are many nuances to opening and maintaining a Roth IRA. The investments, the tax strategies, and the timing of contributions can all make or break your account’s tax-free status. This potentially could cost you additional taxes and penalties.

How to avoid it

Work with a CERTIFIED FINANCIAL PLANNER™ to help you set up, and maintain your Roth IRA. They can help plan for an effective retirement and tax strategy. Having a professional help you with your retirement accounts and other complicated retirement plan strategies can potentially help you avoid expensive Roth IRA mistakes.

To Sum it Up- Don’t make these Common Roth IRA Mistakes

Roth IRAs can provide a lot of great retirement benefits, but they can also be complicated. There are a lot of common mistakes with a Roth IRA. It is important to pay attention to all the regulations and rules to help you avoid these common mistakes.

Have questions about your Roth IRA? Give us a call! We are local in Colorado Springs but help clients all over the nation. We are happy to help.

Client Login

Client Login