We specialize in helping Pilots, like you, Retire with Confidence

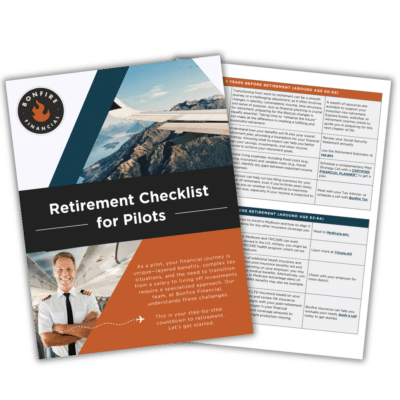

As a pilot, your financial journey is unique—layered benefits, complex tax situations, and the need to transition from a salary to living off investments require a specialized approach. Our team, at Bonfire Financial, understands these challenges. We’ll guide you through a range of challenges unique to pilots, including:

mandatory retirement at age 65

Specialized airline benefits packages

Pension and Social Security payments

Navigating career uncertainties

PROUDLY SERVING PILOTS FROM:

Schedule Your Pilot Strategy Call

and Check Out What Awaits You as a Bonfire Client

and Check Out What Awaits You as a Bonfire Client

Personalized Income Strategy

Tailored guidance to transform your PCRA, Social Security, pension, and other investments into steady monthly income.

Strategic Tax Management

Purpose-built, simple, direct tax efficiency plan for pilots to help minimize taxes and maintain more of what you’ve earned throughout your career.

Customized Long Term Planning

Your journey doesn’t stop at 65, and neither should your planning. That’s why we provide customized long-term care and estate solutions.

A Fiduciary by Your Side

We’ll be your financial co-pilot, guiding you every step of the way to help you implement your plan, stay on track, and retire without worry.

WHY WORK WITH US?

At Bonfire Financial, we specialize in helping pilots navigate the unique financial challenges of transitioning into retirement. As a Registered Investment Advisor (RIA), we are legally bound to act in your best interest—always prioritizing your financial goals above all else. Our team of Certified Financial Planners™ (CFP®) brings the highest standard of expertise, as true Fiduciaries, we offer strategies tailored to the complexities of a pilot’s career, including mandatory retirement, benefits integration, and sustainable income planning.

Unlike traditional financial advisors, our fee-only structure ensures unbiased advice, free from commissions or conflicts of interest. With a deep understanding of the aviation profession, we’re here to help you build a financial plan that aligns with your career, maximizes your hard-earned investments, and provides confidence as you prepare for life after flying.

DON'T TAKE OUR WORD FOR IT...

What Pilots are Saying About Us

These are real, current client reviews and are not paid for.

Pilot Retirement and Financial Planning FAQs

What makes financial planning for pilots unique?

Pilots must plan around mandatory retirement at age 65, unique airline compensation structures, variable schedules, and specialized benefits like pensions and PCRAs. These factors require a tailored strategy to ensure income continuity, tax efficiency, and long-term security.

When and why do pilots face mandatory retirement?

Commercial airline pilots are required by federal law to retire at age 65. This creates a fixed career end date, making it essential to have a retirement plan in place well before that milestone.

How should pilots integrate airline benefits into retirement planning?

Benefits such as Pilot Cash Reserve Accounts, pension plans, 401(k)s, and Social Security should be coordinated into a single income strategy. This integration helps maximize payouts, manage taxes, and ensure stable income throughout retirement.

What does “retiring with confidence” mean for a pilot?

It means entering retirement with a clear plan for income sources, taxes, healthcare, and legacy goals—so you can maintain your lifestyle without financial uncertainty.

Why choose a fee-only Registered Investment Advisor as a pilot?

A fee-only RIA is compensated solely by client fees, not commissions. This eliminates conflicts of interest and ensures that financial recommendations are based entirely on your best interests.

What ongoing support does Bonfire Financial provide to pilots?

We act as your financial co-pilot, providing continuous monitoring of your retirement plan, tax strategies, and investments, and making adjustments as your needs and market conditions change.

How can pilots reduce taxes in retirement?

Pilots can lower tax liability by timing withdrawals strategically, using Roth conversions, and coordinating pension and Social Security benefits. A customized tax plan ensures you keep more of what you earn.

Do you work with airline-specific retirement plans like PRAP or Cash Balance Plans?

Yes. We have expertise in managing and integrating airline-specific retirement plans, including PRAP and Cash Balance Plans, to align with your broader wealth strategy.

What do pilots say about working with Bonfire Financial?

Clients say our planning has helped them prepare for retirement with clarity and reduced stress, especially when navigating airline-specific benefits and timelines.

Client Login

Client Login