When it comes to your Medicare choice, the decisions you make at age 65 (or even slightly before) can have long-lasting consequences. Yet many end up choosing a plan based on general advice, slick marketing, or a brief conversation with their benefits department.

To help cut through the confusion, we sat down with Andrew Mersereau, a Medicare specialist with over 24 years of experience guiding individuals through enrollment, plan selection, and strategy. Andrew is known for his no-nonsense, education-first approach to Medicare and has helped countless clients avoid costly mistakes.

Today we’re breaking down everything you need to know to make a confident, well-informed Medicare choice that fits your needs, especially if you’re financially secure, still working at 65, or considering a Roth conversion or property sale that could spike your income.

Let’s dive in.

Listen Now: iTunes | Spotify | iHeartRadio | Amazon Music

What Is Medicare, Really?

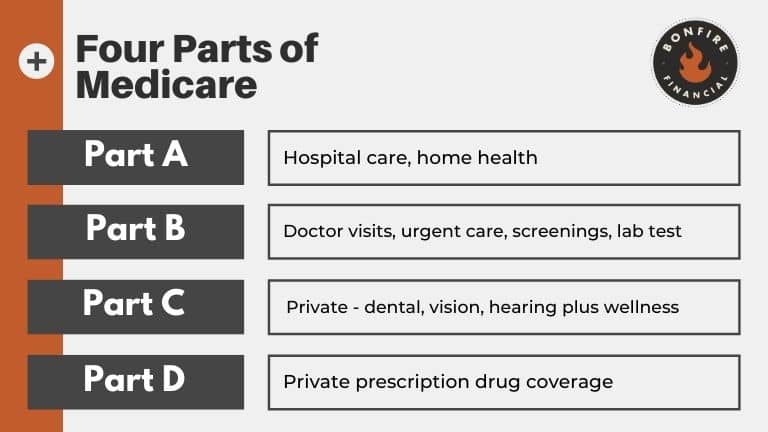

Before diving into strategies, it’s helpful to revisit the basics. Medicare is a federal health insurance program for people 65 and older, as well as some younger individuals with disabilities. But “Medicare” isn’t one plan, it’s a collection of parts:

-

Part A: Hospital coverage (inpatient)

-

Part B: Medical coverage (outpatient care, doctor visits, preventive services)

-

Part C: Medicare Advantage plans offered by private insurers as an alternative to A and B

-

Part D: Prescription drug coverage

Original Medicare (Parts A and B) is provided by the federal government. To cover additional costs and services, many people add Part D and either a Supplement (Medigap) policy or an Advantage plan.

The Big Decision: Supplement vs. Advantage

This is the crossroads most people face, and it’s not as straightforward as it seems.

Medicare Advantage (Part C)

Medicare Advantage plans are offered by private insurance companies and typically include Parts A, B, and D bundled together. These plans often tout extra perks like dental, vision, gym memberships, or transportation to doctor visits.

But those extras come with trade-offs. Advantage plans often:

-

Have narrow provider networks

-

Require referrals for specialists

-

Use prior authorizations for many procedures

-

Limit care to a specific geographic region

These plans are appealing due to their low or zero-dollar premiums, but you may find yourself paying more out of pocket when you actually need care.

Medicare Supplement (Medigap)

Medigap policies work alongside Original Medicare to pay for out-of-pocket costs like coinsurance, copayments, and deductibles. They do not include drug coverage, so you’d add a standalone Part D plan.

Key benefits of Medigap plans:

-

See any provider in the U.S. who accepts Medicare—no referrals needed

-

No network restrictions

-

Predictable costs with limited out-of-pocket expenses

For frequent travelers, snowbirds, or anyone who wants maximum freedom in choosing providers, Medigap is often the better long-term choice.

“People often pick Advantage for the low monthly price, but later regret the restrictions,” Andrew warns. “Your Supplement choice may cost more monthly, but it gives you far greater control.”

Why Your First Medicare Choice Might Be Permanent

Here’s the part most people don’t realize: the choice you make when you first sign up, especially between Supplement and Advantage, can be extremely hard to reverse.

Under federal law, you’re guaranteed acceptance into any Medigap plan only during your initial enrollment period (usually the six months after you enroll in Medicare Part B). After that window closes:

-

Insurance companies can ask health questions

-

They can deny you based on preexisting conditions

-

Approval becomes much more difficult as you age or develop medical issues

Andrew says it plainly:

“In my experience, 80% of people who try to switch from Advantage to Supplement later are denied.”

This is why the decision you make when you first sign up is so critical. Switching may not be an option later.

IRMAA and Income Traps: What Affluent Retirees Need to Know

Medicare premiums aren’t fixed for everyone. If your income is high, you may be subject to the IRMAA (Income-Related Monthly Adjustment Amount). This surcharge applies to Parts B and D and is based on your Modified Adjusted Gross Income (MAGI) from two years prior.

Here’s what can trigger IRMAA:

-

Selling a business or property

-

Large capital gains

-

Taking large IRA distributions

A Common Scenario:

Janet, 64, sells her investment property and earns a $300,000 gain. Two years later, she’s shocked to find her Medicare premiums more than double, she’s now in an IRMAA tier that costs her over $500 more per month.

These are avoidable surprises, but only with proper planning.

Still Working at 65? Don’t Assume You Can Delay Medicare

Many people working past 65 wonder if they can delay Medicare enrollment. The answer: only if you have credible employer coverage.

Your plan must:

-

Cover 20 or more employees

-

Be deemed creditable by Medicare

-

Meet specific drug coverage standards

If it doesn’t, and you delay enrolling, you may face lifetime penalties based on your Medicare choice.

Mersereau’s advice: always confirm with HR in writing that your coverage meets Medicare’s standards, and compare your total healthcare costs before making a decision.

Important: If you’re still contributing to a Health Savings Account (HSA), enrolling in any part of Medicare makes you ineligible to keep contributing.

Medicare Doesn’t Cover Everything. Here’s What’s Missing:

Even the best Medicare plans don’t cover everything. Here are the biggest gaps that surprise people:

-

Hearing aids

-

Routine dental care

-

Eyeglasses and eye exams

-

Long-term care (like assisted living)

-

Home modifications or private-duty nursing

-

Unlimited rehabilitation or therapy

You may need private insurance, Medicaid, or a long-term care policy to bridge these gaps. Supplement plans won’t help with most of these either, they’re for traditional medical expenses only.

For Snowbirds and Travelers: Choose Wisely

If you live part of the year in Florida and the rest in Colorado, or travel often, your plan choice is especially important.

Advantage plans are often limited to regional networks, so out-of-state care may not be covered. Supplement plans allow access to any Medicare provider in the country, making them ideal for travelers or dual-state living.

Timeline: What to Do at 63, 64, and 65

Turning 65 is a major milestone, not just for birthdays, but for healthcare decisions that can impact your financial future. To help you stay ahead of deadlines and avoid costly missteps, here’s a step-by-step timeline of what to focus on at ages 63, 64, and in the months leading up to your Medicare choice and enrollment.

Age 63:

-

Begin tracking your income to anticipate IRMAA brackets

-

Evaluate if Roth conversions, property sales, or business exits are better done now

-

Schedule a financial planning session to model different Medicare scenarios

Age 64:

-

Research Medicare basics using Medicare.gov

-

Make a list of your doctors and medications to compare plan compatibility

-

Talk to a Medicare specialist or broker, ideally one who is fee-transparent and non-commission focused

3-6 Months Before Turning 65:

-

Enroll in Medicare Parts A and B via Social Security

-

Choose either a Supplement and Part D or an Advantage plan

-

Get proof of credible coverage from your employer if you’re deferring enrollment

Red Flags to Watch For

-

Too-good-to-be-true Advantage ads

“Free this” and “zero-dollar that” often hide tight restrictions and surprise bills. -

Advice from friends

Everyone’s situation is different. What works for one person could be a disaster for another. -

Brokers pushing one plan type

A good broker will help you compare, not sell you the highest-commission product. -

Skipping Part D because you take no meds

This can result in penalties later. It’s often smarter to enroll in the lowest-cost plan anyway.

FAQ: Quick Medicare Questions Answered

Q: Is it ever smart to go with just A and B?

A: Rarely. Without a Supplement or Advantage plan, your out-of-pocket costs are unlimited.

Q: Can I change my mind later?

A: With drug plans (Part D), yes. With Supplement plans, possibly, but you may be denied.

Q: What if I have a concierge doctor?

A: You can keep them, but you’ll still need A and B, plus coverage for hospitals, specialists, and serious illnesses.

Q: Does my state affect my ability to switch plans?

A: Yes. Some states have more lenient rules, but most follow the six-month initial enrollment protection rule.

Final Thoughts: The Smartest Move is an Educated One

Andrew Mersereau emphasizes that education, not advertising, should guide your Medicare choice.

“Don’t just follow an ad or assume what worked for a friend will work for you. Take the time to understand what you’re buying and why.”

And remember, using a Medicare broker doesn’t cost you extra. Rates are set by law, and a good broker can help you avoid expensive mistakes.

Whether you’re helping a parent, preparing for your own retirement, or simply curious about your options, the takeaway is clear: Medicare isn’t something to wing. It’s a decision that affects your access to care, your costs, and your peace of mind for years to come.

Need help navigating Medicare?

You can contact Andrew’s team at 719-955-4991. They offer education-driven guidance with no pressure.

Client Login

Client Login