Maxing out your 401k is a major milestone when investing for retirement. It shows commitment to long-term financial planning, a proactive mindset, and an understanding of the power of compound growth. But it also leads to the inevitable question: What do I do next?

If you’re asking this, congratulations, you’re already ahead of the pack. And you’re in the right place to explore your next best steps.

Today, we’ll walk through a structured framework for what to do after maxing out your 401k, diving into Roth IRAs, taxable brokerage accounts, backdoor Roth strategies, and how to think about liquidity, flexibility, and tax planning in your broader investment picture.

Listen Now: iTunes | Spotify | iHeartRadio | Amazon Music

Step 1: Confirm You’ve Truly Maxed Out the 401(k)

First things first: let’s define what “maxed out” means. Check the annual contribution limits < This page is updated annually to make sure you have the most up-to-date numbers.

But here’s a nuance: maxing out your 401k isn’t just about hitting the annual limit. It’s also about making sure you’ve taken full advantage of your company match. Never leave free money on the table. If your employer offers a match (say 100% of the first 4% of your salary), make sure you’re contributing at least that much.

Once you’ve contributed to the max and received the full match, then it’s time to move on to the next vehicle.

Step 2: Explore a Roth IRA

The Roth IRA is often the first recommendation for clients who are looking to invest beyond their 401k, and for good reason:

-

Tax-free growth: You fund a Roth IRA with after-tax dollars, and in exchange, your investments grow tax-free.

-

Tax-free withdrawals: Once you’re 59½ and the account has been open for at least five years, you can withdraw both contributions and earnings tax-free.

-

No required minimum distributions (RMDs): Unlike traditional IRAs and 401(k)s, Roth IRAs don’t require you to take distributions in retirement.

There are annual contribution limits here too.

But don’t worry. There’s a workaround.

Step 3: Consider a Backdoor Roth IRA

If your income is too high for a regular Roth IRA, you may still be able to contribute through a Backdoor Roth IRA. This involves:

-

Contributing to a non-deductible traditional IRA (after-tax money).

-

Converting it to a Roth IRA.

Seems simple, but there are a few caveats:

-

If you have existing traditional IRA balances, the IRS uses a pro-rata rule to calculate taxes, meaning some of the conversion may be taxable.

-

Timing matters. It’s smart to consult a tax advisor or financial planner to execute this properly.

For many high earners, the backdoor Roth can be a powerful tool for adding tax-free growth to their portfolio.

Step 4: Open a Taxable Brokerage Account

Once your tax-advantaged options are maxed out and you want to continue investing for retirement, it’s time to consider a taxable brokerage account. Don’t let the term “taxable” scare you. This type of account actually offers some key advantages:

Advantages of a Taxable Account:

-

Unlimited contributions: Unlike retirement accounts, there’s no cap on how much you can invest.

-

No income limits: Anyone can open and fund one.

-

No early withdrawal penalties: You can access funds at any time.

-

Wide investment flexibility: You can invest in stocks, bonds, mutual funds, ETFs, real estate trusts, private placements, and others.

-

Liquidity: Need to fund a real estate purchase? Pay for a wedding? Start a business? This account gives you that flexibility.

Tax Considerations:

Growth in a brokerage account is taxed, but how it’s taxed matters:

-

Capital gains tax applies to investments held over one year (long-term).

-

Ordinary income tax applies to gains on assets sold within one year.

-

Dividends may also be taxable depending on their classification.

But there are strategies to reduce taxes, like:

-

Tax-loss harvesting: Selling underperforming assets to offset gains.

-

Asset location: Placing tax-efficient investments in your taxable account and tax-inefficient ones in your tax-deferred accounts.

Step 5: Think Flexibly with Your Future in Mind

A common mistake is viewing investment accounts in silos. Instead, think about them as tools that serve different purposes and timeframes.

Here’s how it breaks down:

| Account Type | Best For | Key Benefit |

|---|---|---|

| 401k | Long-term retirement savings | Tax-deferred growth + employer match |

| Roth IRA | Long-term + tax diversification | Tax-free growth + no RMDs |

| Brokerage Acct | Flexibility + early retirement + legacy planning | No contribution limits, no penalties for early withdrawals |

If you plan to retire before age 59½, a taxable account becomes even more important. It gives you penalty-free access to funds while your retirement accounts keep compounding in the background.

Step 6: Use Brokerage Accounts for Creative Planning

Let’s take it a step further.

Real Estate Opportunities

Thinking about buying a rental property? A brokerage account can be tapped to fund a down payment without penalties. This is especially helpful for investors who want to diversify into real estate assets without triggering retirement withdrawal rules.

Tax Bracket Optimization

Planning to retire early? You may enter a lower tax bracket before Medicare or Social Security kicks in. You can draw from brokerage accounts strategically, keeping income low and managing your bracket for Roth conversions or to reduce long-term tax exposure.

Collateralized Lending

Did you know you can borrow against your taxable account? Many custodians offer lines of credit backed by your portfolio. This can be helpful for:

-

Avoiding the sale of appreciated assets (and the taxes that come with it)

-

Making time-sensitive investments

-

Helping family members (like a child’s down payment) without touching the principal

It’s not for everyone, but for high-net-worth individuals, this can be a sophisticated strategy to create liquidity without triggering taxes.

Step 7: Automate and Grow

Just like your 401k, your brokerage account can benefit from automation. Set up monthly contributions to stay disciplined and consistent. Over time, this can grow into a substantial pool of capital.

We often see clients fund these accounts with:

-

Annual bonuses

-

RSU or stock option sales

-

Proceeds from home sales

-

Inheritance windfalls

-

Business profits

By treating it like your 401k, with regular contributions and a long-term mindset, you’ll build serious wealth over time.

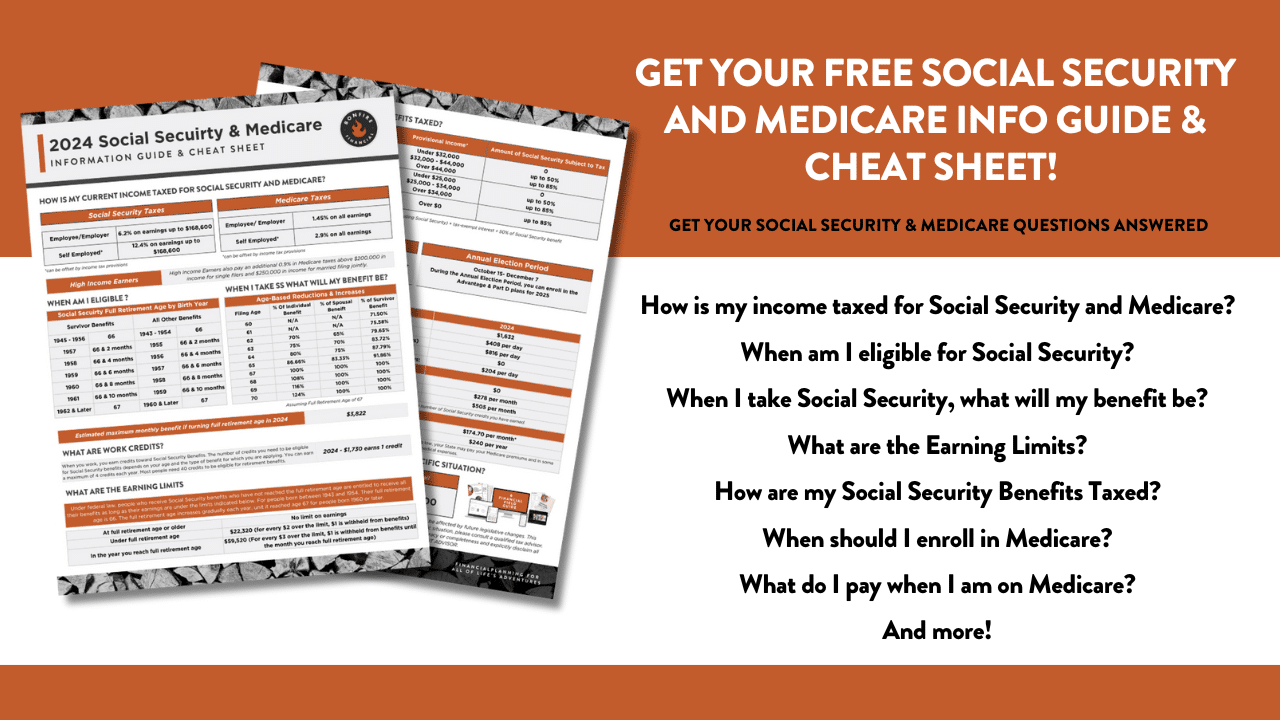

Bonus: Don’t Forget the Other Vehicles

401(k)s, Roth IRAs, and brokerage accounts are the main trio when investing for retirement, but depending on your goals, you might also explore:

-

Health Savings Accounts (HSAs): HSAs are triple-tax advantage (pre-tax contributions, tax-free growth, tax-free withdrawals for medical expenses).

-

529 Plans: For tax-advantaged education savings.

-

Cash-value life insurance: Life insurance can be a niche tool for legacy or advanced planning.

-

Real estate LLCs or syndications: Direct ownership or fractional investments.

Each tool has its own benefits, risks, and tax implications, so work with a financial planner to build a strategy tailored to your life.

Final Thoughts

If you’ve maxed out your 401k as you are investing for retirement, you’re doing something right. But don’t stop there. Understanding what to do after maxing out 401k contributions opens the door to a wider world of wealth-building strategies that are more flexible, tax-aware, and goal-driven.

Here’s a quick recap:

-

Max out the employer match and annual limit in your 401(k)

-

Open a Roth IRA or explore a backdoor Roth

-

Build out a taxable brokerage account

-

Think long-term and flexible, especially for early retirement or large life events

-

Use tax strategies and automation to make your plan efficient and consistent

At Bonfire Financial, we work with clients every day who want to optimize their savings and make the most of their money. If you’re ready to go beyond the basics and build a plan that’s personal, strategic, and forward-thinking, we’re here to help.

Ready to take the next step?

Schedule a free consultation. Let’s map out your next move.

Client Login

Client Login