Titling, wills and trusts

A will helps determine what happens to your assets after you die. In fact, it may be one of the most important documents you have in your lifetime. However, there is a lot more than just a will that you will need if you want to distribute your assets to the best of your wishes, as well as avoiding a probate court from interpreting your will and deciding who gets what.

A will is necessary, but many people do not know that the way a property is titled actually supersedes what is written in the will. By law, whoever is the beneficiary listed on an account or property, that asset will be given to that person, no matter what the will says.

This is an overview of estate distribution, estate vehicles, and how to properly title your accounts to make for an easy transition to your heirs and legatees (aka – the people you love). All while avoiding the headache of probate court.

Let’s go over the basics of titling, the will, and trusts.

The Will and Probate Court

Probate court is a system that deals with the property and debts of a decedent (a person who has died). Its role is to ensure that their debts are paid. In addition to ensuring any remaining assets are distributed according to the will. When a person dies, it is up to the court and the executor to distribute the assets according to the probate declaration.

Probate court can take up to 9 – 15 months to determine and distribute assets to heirs. The costs of probate court can be up to 7-9% of the total amount of the estate. If you only have a will without titling your accounts, your estate is susceptible to the interpretations of the state. Thus, can lead to your estate being distributed against your wishes. Many people seek ways to avoid probate as the time and cost can greatly harm and inconvenience their estate and their heirs.

There are several ways to avoid assets going through probate. They are trusts, legal titling, and beneficiaries by contract.

The Will and Titling

A valid will is extremely important to have because it will give instructions to the court about how your assets will be distributed.

When someone dies with a valid will, they will die “Testate” meaning their assets will transfer through the probate court to their heirs and legatees. A legatee is an heir that is specifically named in the will.

If you do not have a valid will, you will die “Intestate” which means the courts will determine who will receive your property based on closest familial relation.

If you do not have a will or a known family, your assets will be gifted to the state! As an example of how common this is, the state of Colorado alone is holding over $400 million in unclaimed money from its residents. If your desires are to benefit someone outside of your immediate family, you would need a will to state this.

Wills are the basic tool for estate planning, but they are susceptible to the interpretation of the courts. Wills must go through probate. Which may allow your heirs to potentially negate who you named in your will if it does not seem appropriate or valid for any reason. A will can be argued by the courts and the heirs, so it is not completely secure. If any property is left out of the will, that would also be subject to the interpretation of the court.

Titles by Law

Titles are very useful in making a very simple statement of who is the owner of the asset and who is the beneficiary. When you title an account or asset, the person that you have listed can either be part-owner of that asset or the beneficiary.

When a couple buys a home jointly, the couple owns an equal share of the house and they cannot do anything with it without the other’s permission. If one of the spouses were to die, the other surviving spouse would gain 100% of the value. Except for property titled as “Community Property”, all titles supersede the will.

Ways to title and asset

There are many ways to title an asset. This is how they all work and what makes each different.

- Fee Simple: The account is titled in your name only. It will have to pass by the will.

- Joint Tenants with Right of Survivorship (JTWROS): Pass by law directly to the surviving account holder when the first account holder dies. This title will supersede the will.

- Tenants in Common: Titling is split by the amount of ownership contribution proportionally. The other holder does NOT have the ability to own your part if you die. This titling is used for business partners that contribute to assets together but do not want their assets to pass to each other.

- Tenants by Entirety: Similar to JTWROS, but only for married spouses. Passes 100% to the surviving spouse by law.

- Community Property: If you live in a “Community Property” state, each spouse independently owns 50% of an asset and can do with it whatever they please. This does NOT necessarily transfer to the spouse as does JTWROS. You can list the heir to whoever you please. The states that use Community Property instead of JTWROS or Tenants by Entirety are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. If you live in these states, you will have to plan differently for distributing your property and assets. Seek estate counsel from an estate planner to effectively protect and direct your assets to your wishes.

Titles by Contract

There are many accounts that someone cannot list another person as the owner of the account. For example, you cannot have your spouse titled on your Individual Retirement Account (IRA) or 401(k), because it is a single-person account. However, you can add your loved ones to your account as beneficiaries.

Interestingly, only you can have access to your individual accounts even if you are married. These types of accounts are not passed by “Law” as joint accounts are, but are passed by contract; which asks who is the listed beneficiary on the account. Passing by contract avoids probate and always supersedes the will. It is crucial to not only update your will with major life changes but to review your beneficiaries as well.

If an ex-spouse is listed as the beneficiary of your IRA, your IRA will pass to your ex-spouse. Regardless if the update will direct your IRA to your children. There is no way for the court to interject in this mistake because it never goes to Probate Court.

Retirement accounts such as IRA’s and 401(k)’s use beneficiaries. For bank accounts, you will need to add a Transfer on Death (TOD) to your account. A TOD will be the individual or charity that the account will transfer to. Titles by contract are used for financial accounts. For real assets, such as homes, cars, and property, these assets must be listed in the will or stated in a trust.

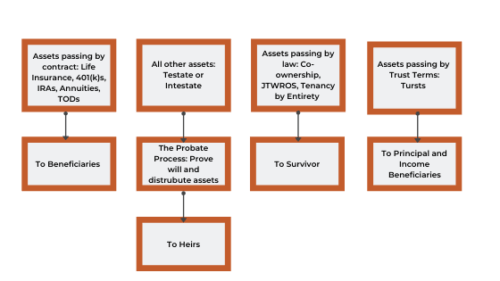

Here is an infographic that demonstrates assets passing through and around the probate process:

Trusts

A trust is a vehicle that a person (grantor) makes to be held in trust by the trustee, for the benefit of the beneficiary. A trust is a useful arrangement that allows the grantor and the trust to avoid probate. It also allows the grantor to control the trust beyond the grave.

Trusts were once extremely necessary for anyone who had over $1 million in total assets. In 2002, your estate would be taxed at 50% of any amount over $1 million! Families leverage trusts to move money out of their estate and help protect their assets for their beneficiaries.

This is no longer the case, as the current credit has been raised to $11 million. Thus, protecting most people from having to pay any “Death Tax”. Trusts are still popular and useful because they are taxed as their own entity. They are shielded from the estate’s creditors. Also, they can distribute money periodically to their heirs instead of a lump sum payout through the will.

Contingencies

The trust can allow for contingencies such as divorces and deaths that could occur in the future. For example, if a mother was concerned that her children may spend their inheritance if she were to die, she could establish a trust that would that only distribute 10% of its assets to the heirs each year. This trust declaration would still benefit her children. However, it would make sure that they would not spend it immediately.

Trusts are also useful to implement when a parent may be worried that their child may divorce a partner in the future. If the father wrote a will, the proceeds could be split between the spouses upon divorce. In a trust, the parent could stipulate that only their child would receive 100% of the benefit if a divorce were to occur.

This is “Controlling the Estate Beyond the Grave”. It’s just one example of the various tools a trust can have for a person to always make sure their money is going where they intended it to go.

The trust also protects one’s assets from the claims of creditors. A probate court by law awards the estate’s creditors first and then distributes what is left to the heirs. A trust protects the assets from creditors. It also distributes them immediately to your heirs or listed charities as the trust stipulates. If a trust seems like a good tool for your specific estate plan, a lawyer or estate planner can help you build a trust as the cornerstone of your estate plan.

The Bottom Line

There are various tools and vehicles you can use to direct your assets and estate when you die. To recap, the four ways that assets pass from the decedent’s estate to their heirs and legatees. By the will and probate, by law of titling, by contract of beneficiary, and by the terms of the trust.

Each one has its advantages and disadvantages. For example, the will is very simple and inexpensive to create but will be subject to the probate court. A trust will have the advantage of avoiding probate, but are can be expensive and convoluted in nature. Further, real assets like your house, cars, and property typically cannot have a listed beneficiary and must pass through the will or a trust.

The most important lesson is to review your accounts, titling, and estate documents to ensure they are all up to date and clearly represent your best wishes. Speak with an estate planner that you trust to help guide you.

Where a Financial Advisor comes in

Estate planning is an often overlooked aspect of financial planning. However, a financial advisor can help play a major role, working in conjunction with your estate planner. First, they can help keep your beneficiaries up to date on your investment accounts. They can help advise you on how certain life changes may impact your estate plan, most specifically retirement. Finally, if you do not have a will or estate plan in place that can help you find a good one. We know many great estate planners who can help you get your will and titling done right. Want to get started? Schedule a free consultation call today.

Client Login

Client Login