If you’re a Southwest pilot, you recently received many needed changes to your benefits package through the Contract 2020. The introduction of the SWAPA Market-Based Cash Balance Plan (MBCBP) has piqued the interest of many Southwest pilots. As a CERTIFIED FINANCIAL PLANNER™, I’ve had the privilege of working with over 50+ pilots, just like you, helping them get on the right track to a successful financial life and retirement as their Fiduciary advisor. My specialization in Southwest pilot benefits helps me to guide you in maximizing your career earnings, benefits, and wealth.

HOW THE SWAPA MARKET-BASED CASH BALANCE PLAN WORKS WITH YOUR CURRENT PLAN

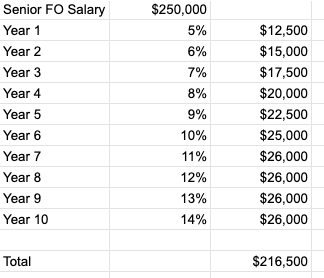

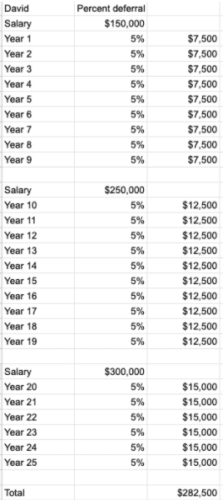

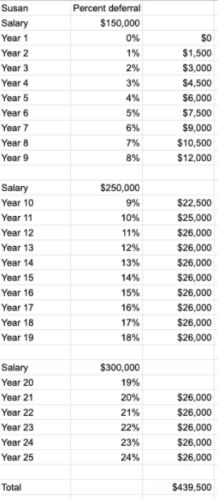

The Market-Based Cash Balance Plan allows you to increase your retirement savings without increasing your current taxes. Once you maximize your 401(k), the 17% contribution from Southwest will then spillover into the MBCBP, on top of contributing 1% of your salary into the MBCBP, and then 2% of your salary starting in 2026 if you spillover or not.

Many pilots are running into the issue of maximizing their 401(k) and wanting other ways to save for retirement. The MBCBP is the benefit that will solve this issue. The MBCBP allows Southwest’s 17% “spillover” contributions to go into a pre-tax retirement account rather than be given to you via taxable check. The spillover occurs when you reach either the 415(c) Limit or the 401(a) Limit.

The 415(c) Limit sets the total cap on contributions to your 401(k) from both your employee and employer contributions. For individuals under 50, this limit stands at $69,000, while those 50 or older have a total limit of $73,500. Meeting this limit can occur when maximizing your employee 401(k) contributions, which are:

- $23,000 for individuals under 50

- $30,500 for those aged 50 or older

This means that you can contribute the $23,000 or $30,500 (50 years+) to your 401(k) and Southwest will contribute 17% of your salary up to the total limit including your contribution of $69,000 or $73,500 if 50 years +.

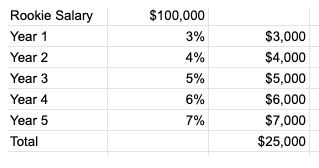

The 401(a) Limit limits the amount of salary that can be considered that Southwest can contribute their 17% to. In 2024, this limit is set at $345,000. Southwest can only contribute 17% of your salary up to $345,000. If your salary exceeds this amount, Southwest’s 17% contribution will spill over to you (or the MBCBP). For example, if your salary reaches $445,000—$100,000 over the limit—this excess 17% translates to $17,000 as spillover into the MBCBP.

>> These are 2024 numbers- Click here for this year’s current numbers <<<

BENEFIT OF THE SWAPA MARKET-BASED CASH BALANCE PLAN

So, what exactly is a Cash Balance Plan? It serves as a retirement account, much like your 401(k). However, it has the capacity to hold a more significant sum for retirement than traditional retirement accounts. While a 401(k) is constrained by an annual limit—$69,000 or $73,500 if 50+ in 2024, for instance—a Cash Balance Plan can theoretically accommodate contributions of up to $300,000 annually. This account operates differently from a 401(k). It follows a “Defined Benefit” model, allowing for higher contributions to support specific benefits, such as an annual pension.

The Market-Based Cash Balance Plan is a deferred plan, meaning you don’t pay taxes on company contributions or growth within the account. Instead, taxes are paid when you withdraw funds during retirement, aligning with your income tax level at that time. This structure can be advantageous, as it doesn’t increase your taxes while working, potentially leading to lower lifetime taxes.

Regarding investment management, SWAPA Cash Balance Plans prioritize a “reasonable return” within strict ERISA and IRS guidelines to safeguard the defined benefit. As such, investments in the MBCBP aren’t subject to individual choices but rather managed collectively by a committee. Upon retirement, you have the flexibility to roll over the MBCBP into an IRA. This will grant you greater control over investment decisions. You also have the option to take a pension from the account. The pension amount is based on the value of the MBCBP, when you take your benefit, and if you elect to have survivor benefits as a feature to your pension. Determining if taking the pension or the lump-sum transfer into an IRA can be a decision that can have a major impact on your retirement. Discuss with a CERTIFIED FINANCIAL PLANNER on which option might be best for your retirement strategy.

A limitation with the Southwest Cash Balance Plan is that you as an employee cannot contribute to the account. It is only funded by the employer via the 1% contribution (2% in 2026) and any spillover above the 415(c) or 401(a) limits.

IS A MARKET-BASED CASH BALANCE PLAN RIGHT FOR YOU?

Should you consider using the SWAPA Cash Balance Plan? If you want to save more for retirement, especially as retirement draws nearer, it could be a valuable tool. Are you worried about paying too much in taxes and do not need the extra cash? This could be an advantageous option for you. If you want to increase your current income to pay for current bills and goals, you may want to continue using the cash spillover.

OTHER OPTIONS TO MAXIMIZE YOUR RETIREMENT STRATEGY

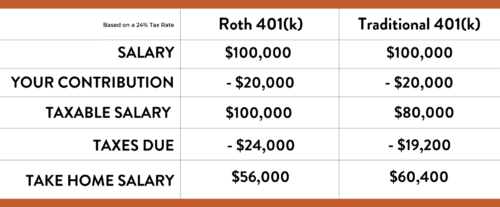

Additionally, you can maximize your 401(k) contributions further by taking full advantage of your personal contribution limit:

- $23,000 for individuals under 50

- $30,500 for those aged 50 or older

By doing so, you not only bolster your retirement savings but also may enjoy significant tax benefits. Contributions are tax-deductible, potentially leading to substantial tax savings.

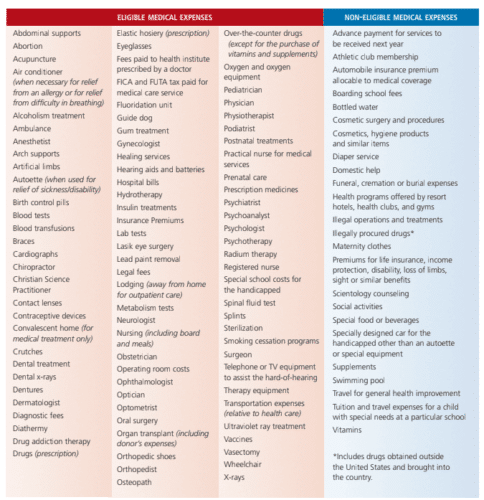

Furthermore, you may consider diversifying your retirement savings by exploring Tax-Free retirement options like the Backdoor Roth IRA Conversion. This strategy can help you build tax-free retirement income while avoiding Required Minimum Distributions (RMDs).

NEXT STEPS

To ensure you’re making the most of your 401(k) and SWAPA benefits, consider discussing your retirement goals with a CERTIFIED FINANCIAL PLANNER who specializes in helping pilots plan for retirement. I’ve worked closely with many pilots, helping them get on the right track to a successful retirement and financial life, and I’m here to help you achieve your financial goals and maximize your benefits and wealth.

Let’s have a conversation about your financial goals and explore the strategies that can help set you on the path to financial freedom and a prosperous retirement. Set up a free consultation call today to learn more about how we can help you!

Looking for information about the United Pilots Cash Balance Plan? Read more on that here!

Client Login

Client Login