The benefit of aging: Catch-Up Contributions

In the most recent episode of The Field Guide Podcast, Brian Colvert, CFP®, takes a fresh look at aging – not as a decline, but as a time brimming with opportunities, especially when it comes to building a secure retirement. Brian dives into the often-underutilized benefits of increasing contributions to retirement accounts as you get older, demonstrating how these seemingly small tweaks can significantly impact your financial future.

Listen Now:

iTunes | Spotify | iHeartRadio | Amazon Music | Castbox

Leveraging Catch-Up Contributions: A Detailed Look:

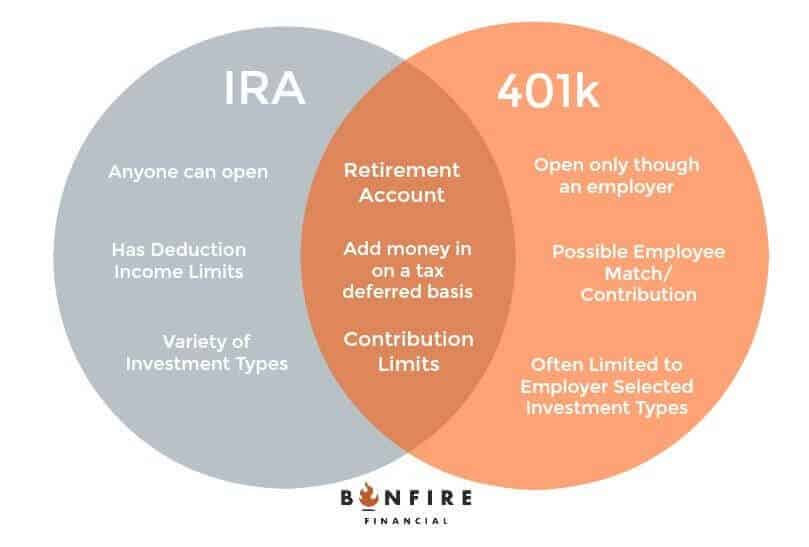

One of the perks of aging is the ability to contribute more to retirement accounts like IRAs, 401(k)s, and HSAs. Let’s break down the specifics and explore why maximizing these contributions is crucial.

IRAs and Roth IRAs: The standard contribution limit for both Traditional and Roth IRAs for 2024 sits at $7,000. >> Click here to see this year’s limits << However, individuals aged 50 and above are eligible for Catch-up contributions, allowing them to add an extra $1,000, bringing their total contribution to a substantial $8,000. Don’t let high income discourage you; strategies like the Backdoor Roth conversion can help you take advantage of these benefits, even if your income exceeds the Roth IRA contribution limits. Here’s a deeper dive into the backdoor Roth conversion:

Backdoor Roth Conversion: A Backdoor Roth is a strategy that involves contributing to a traditional IRA and then converting those funds to a Roth IRA. There are tax implications associated with this conversion, but for those who wouldn’t qualify for a direct Roth IRA contribution due to income restrictions, it can be a valuable way to access the tax-free growth benefits of a Roth IRA in retirement.

Company Plans: Similar benefits exist for company-sponsored plans like SIMPLE IRAs and 401(k)s. Catch-up contributions are available for those over 50, allowing them to significantly increase their contributions and accelerate retirement savings. Let’s explore some additional considerations for company plans:

Employer Matching: Many employers offer matching contributions on employee contributions to retirement plans. This essentially translates to free money for your retirement. Be sure to contribute at least enough to capture your employer’s full match. It’s like leaving free money on the table if you don’t!

Investment Options: Company plans often offer a variety of investment options within the plan. Understanding your risk tolerance and investment time horizon is crucial when choosing how to allocate your contributions within the plan. We recommend seeking guidance from a CERTIFIED FINANCIAL PLANNER™ regarding your best investment options.

The Power of Compounding Interest with Your Catch-Up Contributions

Here’s where the magic truly happens: compounding interest. Even seemingly small additional contributions can snowball into a significant sum over time. Consider this: a $1,000 extra contribution to an IRA each year, consistently invested for 15 years with a moderate 6% rate of return, could grow into over $23,000. This is the magic of compounding interest working in your favor. Let’s delve a little deeper into the concept of compounding interest:

Exponential Growth: Compound interest allows your money to grow exponentially over time. Your earnings not only come from your initial contributions but also from the interest earned on those contributions. This creates a snowball effect, accelerating the growth of your retirement savings.

Time is Your Ally: The longer your money is invested, the greater the impact of compounding interest. Starting to contribute to retirement savings early and taking advantage of catch-up contributions later allows you to maximize the power of compounding interest.

HSA: A Tax-Advantaged Powerhouse – Unveiling the Benefits

The benefits extend beyond traditional retirement accounts. HSAs (Health Savings Accounts), often overlooked in retirement planning, offer additional avenues for saving. Individuals aged 55 and above can contribute an extra $1,000 on top of the standard limits as of 2024.

>> Click here to see this year’s limits <<

Let’s explore the unique advantages of HSAs:

- Triple Tax Advantage: HSAs boast a unique “triple tax advantage.” Contributions are tax-deductible, investment earnings grow tax-free, and qualified medical withdrawals are tax-free. This makes HSAs a powerful tool for saving for future medical expenses while minimizing your tax burden.

- Portability: HSAs are portable, meaning the funds belong to you, not your employer. You can retain your HSA even if you change jobs, providing long-term financial security for healthcare costs.

Embrace the Silver Lining:

Growing older comes with its challenges, but it also unlocks valuable opportunities to solidify your financial future. By maximizing catch-up contributions and strategically utilizing retirement accounts, you can pave the way for a secure and comfortable retirement. Remember, you’re not alone in this journey. If you have any questions or need guidance on your retirement planning path, don’t hesitate to reach out.

Taking Action:

Catch-Up Contributions are just the start. Here are some actionable steps you can take today:

- Schedule a consultation with a CERTIFIED FINANCIAL PLANNER™: Discuss your retirement goals and explore personalized strategies to maximize catch-up contributions and retirement savings.

- Research retirement account options: Understand the contribution limits, tax implications, and investment options for IRAs, Roth IRAs, 401(k)s, and HSAs.

- Review your current contributions: Analyze your current contributions to retirement accounts and consider increasing them to take advantage of catch-up provisions.

- Automate your contributions: Setting up automatic contributions ensures you’re consistently saving towards your retirement goals.

By taking these steps and embracing the opportunities that come with age, you can transform your retirement from a distant dream into a fulfilling reality.

Client Login

Client Login