What business owners need to know about Colorado Secure Savings Act

In 2020 Colorado passed the Colorado Secure Savings Program. This law mandates that small business owners enroll in a state-run retirement savings plan. The pilot program launched in October 2022 and employers throughout Colorado are now required to comply.

The purpose of this mandate is to increase access to retirement savings for workers in Colorado. The Colorado Secure Savings Act mandates that qualifying employers provide an employer-sponsored individual plan. The cost of this program will be funded through auto payroll deductions.

In general, this seems like it will have positive benefits for employees. However, it may create additional burdens for employers and may in fact limit employees’ options. Here is what small business owners need to know about the Colorado Mandated Small Business Retirement Plan.

Who needs to comply:

The Colorado General Assembly states that you, as an employer, will be required to implement this program if:

- You have five or more employees

- Have been in business for two or more years

- Don’t have an existing qualifying plan

Companies already offering 401ks or other qualified savings plans are not required to use the Colorado Secure Savings Program. The law states that employers with less than 5 employees or who have not yet been in business for 2 years will not be required to participate. However, they will have the option to offer the program to their employees.

What needs to be done:

While there is limited guidance at the moment from the State of Colorado, employers will be required to offer auto-enrollment and facilitate payroll deductions into the program.

Upon enrollment, employees will opt into the default savings rate for Colorado Secure Savings, which is 5% of their gross pay. Beyond this, deferral rates may vary depending on how much you want to save each year. In addition, age, marital status, and income play a role in the amount that employees can contribute.

However, employees will be able to change their contribution amount or opt-out if desired.

As it is written so far, employers will have 14 days to send employees’ contributions to the program administrator. The program oversight will be done by the board of the Colorado Secure Savings Program. The board is currently chaired by the Colorado State Treasurer. This board will be making a process for withholding employees’ wages and remitting withheld amounts into their Colorado Secure Savings account. It’s not yet clear if the program will offer any integrations with payroll providers to facilitate the timely deposit of contributions.

Penalties for noncompliance:

Fines can be costly. For non-compliance, fines will be $100.00 per employee per year and can ratchet up to $5000.00 annually. The compliance period is one year after implementation.

However, they do state they plan to create a grant program to incentivize compliance. Yet no further details have been released. The good news is it’s really easy to comply by setting up a 401k plan or another qualified plan in advance. Keep reading on to find out how.

General Concerns:

There is little to no guarantee of the level of quality or support that will be available to business owners from the state in implementing and managing the Colorado Secure Savings Program. The government has not released any real guidelines. There are some basics, but how is still very undefined.

Further, if a company offers the state-run plan many of their higher income employees will be excluded. Employees with a Modified Adjusted Gross Income of more than $139,000 or $206,000 married filing jointly cannot participate.

As we wait for more details it’s not a bad idea to consider all the various plan options available to you and your company.

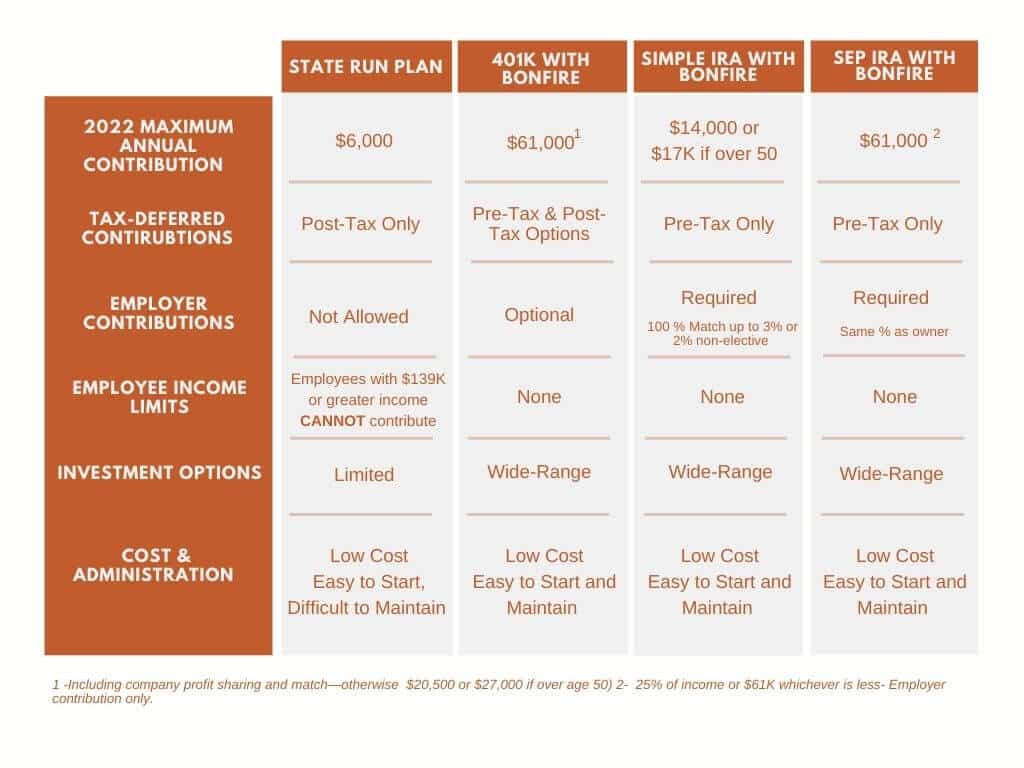

State Sponsored vs Employer Sponsored

There are a handful of states that currently have state mandated plans in place. California, Oregon, and New York are a few for instance. State sponsored plans have pros and cons, which business owners should carefully weigh. On one hand, government-mandated plans are generally a cheap solution with few fiduciary implications. On the other, these plans tend to be inflexible, one-size-fits-all. Plus they come with potential government penalties.

State sponsored retirement plans:

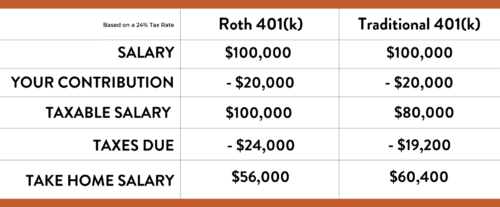

- Roth IRA Investment structure (after-tax)

- The state board selects investments

- The plan will “travel with” people if they change jobs or leave the state

- Excludes higher income employees

- No employer contributions

- No federal tax credits for employers

- Creates a significant burden for the employer

As an alternative, an employer sponsored 401k or other qualified plans may be a better option than having the state do it for you. A common misconception is that employer sponsored plans are expensive. However, that simply isn’t the case. Many plans are now being tailored for smaller companies. Plus, the IRS gives tax credits to firms with fewer than 100 employees for some ordinary and necessary costs of starting an employer sponsored plan.

Employer Sponsored 401K plans:

- Allow an employee to make contributions either before or after-tax, depending on plan options

- Wide range of investments at various levels of risk chosen by the employer or by an advisor

- Employee may direct their own investments

- Higher Annual Salary Deferral Limit

- No employee income limits

- Allows for employer contributions

- Federal tax credits for the employer for start-up and admin costs and employee education

In addition, offering an employer-sponsored plan to your employees may increase your company’s competitiveness in the job market. It could also help you retain valuable staff. Plus, you and other company leaders can participate.

If you work with a payroll services provider, the software can easily and automatically transfer employees’ funds, making the procedure effortless. Additionally, private plans typically come with the support of financial advisors. Moreover, a financial advisor can help regarding plan types and how best to implement them for your business.

Clearly, adding a 401k or other qualified plans to your company’s benefits package has strategic advantages. Yet, by not providing your employees with a retirement plan, you risk having the state impose one.

Do State-Run Plans Even Work?

Time will tell. However, Oregon, the first state to legally mandate a retirement plan, has pretty dismal enrollment numbers. Since its inception in 2018, only 114 thousand workers have enrolled out of a potential of over 1 million total.

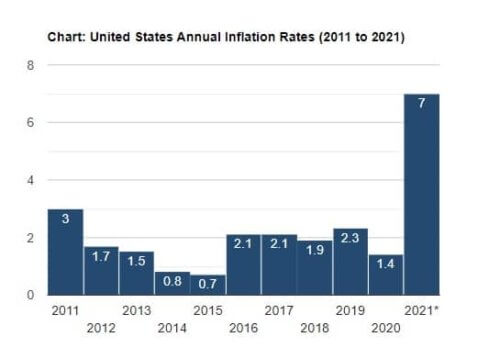

Using Oregon again as an example, there are a lot of restrictions. First, the percentage contribution is fixed. Second, the employee’s first $1,000 gets put into a stabilization fund that since its inception has earned 1.52% per annum, or basically 0%, Or less after factoring in inflation. Finally, if and when they have more than $1,000 invested, they must decide between a fund that is a mixture of stocks and bonds and one that is invested entirely with the State Street Equity 500 Index Fund. (03/31/2022)

By comparison, in the private sector, there are multiple low-cost, exchange-traded funds, most of which averaged an annual return of over 10% during the most recent 10 year period. Some would argue that directing employees away from these superior investment products arguably does a disservice to the employees.

Sample Administrative Duties

Further, Oregon has demonstrated what a significant burden the plan can be on employees. Here is a short list of employer duties that Colorado will likely have as well.

- Submit an employee census annually

- Track eligibility status for all employees

- Provide enrollment packets to all employees 30 days after date of hire

- Plus, track whether each employee has opted in or out

- If an employee doesn’t opt out within 30 days, set up 5% payroll deduction

- Manually auto-escalate all employees annually unless they’ve opted out

- Repeat auto-enroll process annually for all employees who have opted out

- 6-month look-back for auto-escalation:

- Track if the employee has been participating for 6 months with no auto-escalation

- Provide 60-day notice if they do not opt-out again

- Hold open enrollment

- Auto-enroll anybody who hasn’t been participating for at least 1 year

It’s too early to know whether state-run programs work. After all, Saving for retirement is a marathon, not a sprint. As an employer, it is important to weigh all options.

What Are Alternatives to the Colorado Secure Savings Program?

If you do not already have an existing plan, and you are skeptical about a government-mandated plan, you can always make your own employer-sponsored plan. Bonfire Financial has many 401k, Simple IRA, and SEP IRA options. We provide affordable, hassle-free solutions that will reduce the administrative burden.

Colorado Secure Savings vs Retirement Plan with Bonfire Financial

How can my business establish its own retirement plan?

Above all, retirement plans don’t have to be expensive or difficult to manage. In light of Colorado’s rollout of the Secure Savings Plan, we are offering small business owners and employers a free, no-obligation call with a CERTIFIED FINANCIAL PLANNER™ to help answer all your questions. We can help you create a better, more efficient retirement plan that is tailored to you and your employee’s specific needs. We are local in Colorado Springs and are here to help with all your retirement plan needs.

Client Login

Client Login