iTunes | Spotify | iHeartRadio | Amazon Music | Castbox

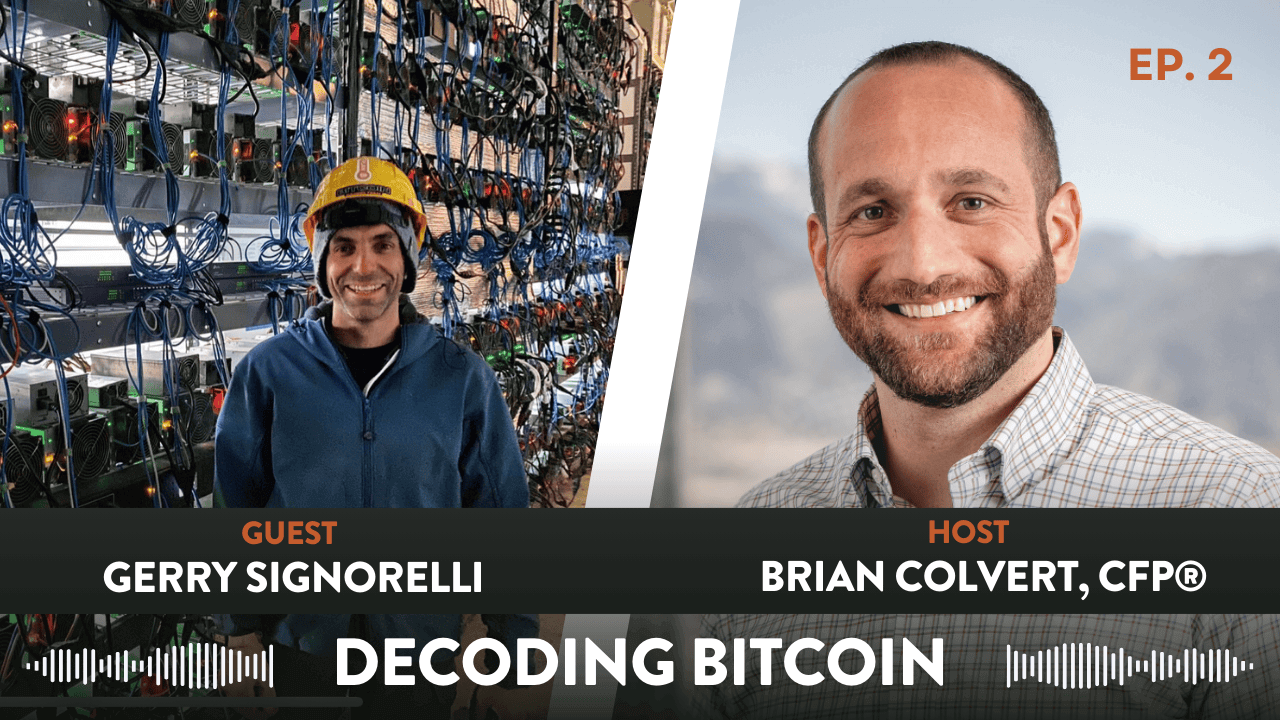

Decoding Bitcoin with Gerry Signorelli

We often get asked what is Bitcoin all about by our clients, and for good reason. The landscape of cryptocurrency is riddled with terms like “blockchain,” “mining,” “nodes,” and “wallets,” which can be confusing and create a steep learning curve. The underlying technology, though revolutionary, is not always straightforward, leading to questions about how it operates, its value proposition, and its role in the financial ecosystem.

Gerry Signorelli has immersed himself into the world of Bitcoin, having built and operated a significant Bitcoin mine and integrated the digital currency into his daily life for various purposes, from savings to international transactions.

We were grateful to have Gerry on the most recent episode of The Field Guide Podcast to break down what is Bitcoin. He shares his extensive experience with the cryptocurrency, provides insights on its advantages over other cryptocurrencies, and discusses the essential role of nodes in maintaining the network’s decentralization. Gerry also addresses common concerns about Bitcoin’s security and its future potential, offering a comprehensive view of how Bitcoin operates.

A Journey from Stable Coins to Mining

Gerry’s foray into the financial world began with a quest for a saving mechanism, leading him from the realm of stablecoins to the discovery of Bitcoin. Despite experimenting with other cryptocurrencies, Gerry found his home with the currency, drawn by its fundamental differences, use cases, and the depth of its structure compared to the fleeting allure of ‘shitcoins.’

Why Bitcoin Stands Out

Bitcoin’s appeal lies in its foundational principles – scarcity, decentralization, and the prevention of censorship. Unlike other cryptocurrencies, Bitcoin’s limited supply, coupled with its robust and decentralized verification process, establishes it as a more stable and reliable digital asset. Gerry articulates the journey of money throughout human history, positioning Bitcoin as the latest evolution in this continuum, offering a digital solution to age-old problems of currency debasement and lack of control over personal wealth.

The Intricacies of Mining

Mining is not just a business for Gerry; it’s a crucial component of Bitcoin’s infrastructure. He delves into the complexities of Bitcoin mining, explaining how it serves as a mechanism for distribution and validation within the network. The process, while energy and capital-intensive, is vital for the creation of new Bitcoins and securing the network against potential attacks.

Understanding Bitcoin Transactions

Transactions in Bitcoin are more than mere financial exchanges; they signify the transfer of control over the digital asset. Gerry discusses how these transactions occur on the blockchain, ensuring transparency and security without the need for intermediary validation.

The Role of Nodes in Decentralization

Brian and Gerry dive into the importance of nodes in the ecosystem. These nodes, which any individual can run, are the backbone of Bitcoin’s decentralization, ensuring that the network remains secure and operates without centralized control. They allow for a democratic verification process that aligns with the ethos of Bitcoin – providing a system where everyone has a say in its operation.

Bitcoin’s Safety and Accessibility

Addressing concerns about Bitcoin’s safety, Gerry outlines the spectrum of ways one can own Bitcoin, from ETFs to cold wallets, each offering different levels of security and convenience. The decentralized nature of Bitcoin, coupled with the ability for individuals to run nodes, ensures that the system remains robust against potential threats.

The Future Outlook

Gerry envisions a bright future for Bitcoin, predicting a significant increase in its value as more people, institutions, and governments recognize its potential. He foresees a world where Bitcoin facilitates freedom of transaction, protects against inflation, and offers a new standard of financial autonomy.

In summary, Gerry Signorelli’s insights into Bitcoin present a compelling narrative of its potential to revolutionize our financial landscape. From its role in savings and transactions to its fundamental principles of scarcity and decentralization, it stands as a beacon of financial innovation in the digital age. As we navigate the complexities of our global economy, Bitcoin offers a promising alternative, challenging traditional financial systems and offering a new paradigm for money in our increasingly digital world.

We hope you enjoyed this episode! Have more questions about Bitcoin or digital currencies? Feel free to reach out to us with any questions! Be sure to like, review, and subscribe wherever you listen!

Client Login

Client Login